Top Industry Leaders in the Performance Coatings Market

The performance coatings market, a segment distinct from its decorative counterpart, thrives on delivering superior functionality and durability. This sector caters to industries like construction, aerospace, automotive, and electronics, where coatings play a critical role in protecting, enhancing, and extending the life of substrates. Understanding the competitive landscape within this dynamic market requires a deep dive into key strategies, market share influencers, recent developments, and industry news.

The performance coatings market, a segment distinct from its decorative counterpart, thrives on delivering superior functionality and durability. This sector caters to industries like construction, aerospace, automotive, and electronics, where coatings play a critical role in protecting, enhancing, and extending the life of substrates. Understanding the competitive landscape within this dynamic market requires a deep dive into key strategies, market share influencers, recent developments, and industry news.

Strategies for Success: A Player's Handbook

Leading companies in the performance coatings market employ diverse strategies to gain an edge. Here are some prominent approaches:

-

Product Innovation: Continuous development of new formulations with improved properties like corrosion resistance, heat tolerance, and anti-fouling abilities remains a top priority. AkzoNobel's Interpon D1035 powder coating, boasting superior weatherability for architectural applications, exemplifies this focus. -

Geographic Expansion: Entering emerging markets with high growth potential like China and India is a key strategy. PPG's acquisition of Tikkurila in 2021 provided them with a strong foothold in the Nordic and Eastern European markets. -

Sustainability Initiatives: Developing eco-friendly coatings with reduced VOCs and utilizing bio-based materials is gaining traction. BASF's launch of its Cradle to Cradle certified Gamacoat waterborne coating for wind turbine blades showcases this trend. -

Partnerships and Acquisitions: Collaborations with research institutions and strategic acquisitions of specialized technology providers can accelerate innovation and expand product portfolios. Axalta's acquisition of Metalflake, a specialist in metallic and pearlescent pigments, exemplifies this approach. -

Digital Transformation: Embracing digital tools like AI-powered formulation optimization, e-commerce platforms, and data analytics is crucial for improving efficiency and customer service. Jotun's development of a digital color selection tool for architects and designers demonstrates this trend.

Factors Influencing Market Share: The Winning Formula

Several factors influence market share distribution in the performance coatings market:

-

Technology Leadership: Companies with superior R&D capabilities and innovative product offerings tend to hold a larger market share. -

Manufacturing Efficiency: Optimizing production processes and minimizing costs can give a competitive advantage. -

Distribution Network: Having a strong and well-established distribution network ensures wider market reach and faster product delivery. -

Brand Reputation: A strong brand image built on quality, reliability, and customer service fosters trust and loyalty. -

Regulatory Compliance: Adherence to strict environmental and safety regulations is crucial, especially in Europe and North America.

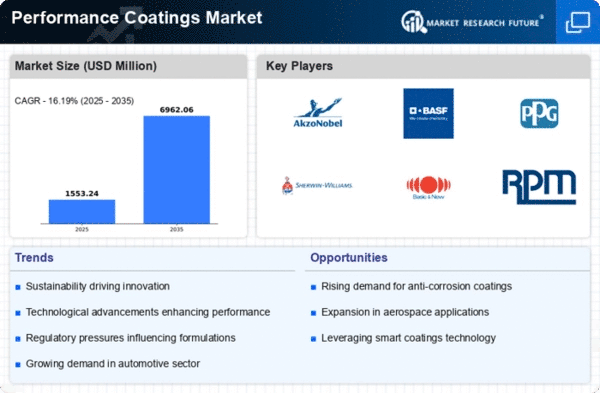

Key Players:

- Akzo Nobel NV (Netherlands)

- PPG Industries Inc. (US)

- Kansai Nerolac Paints Limited (India)

- Metal Coatings Corp. (US)

- Toefco Engineered Coating Systems Inc. (US)

- Endura Coatings LLC (US)

- Beckers Group (Germany)

- Nippon Paint Holdings Co. Ltd (Japan)

- The Sherwin-Williams Company (US)

- AFT Fluorotec Ltd (UK)

- The Chemours Company (US)

- Hempel Group (Denmark)

Recent News

As the largest building materials exhibition in Taiwan, The Taipei Building Show witnessed new products such as printed Tedlar PVF solutions and PVF coatings, among others, unveiled by Coryor Surface Treatment Company Ltd. and Nippon Paint Taiwan in December 2023.

In March 2022, AkzoNobel launched the Interpon ACE powder coating range aimed at satisfying growing needs within Agricultural and Construction Equipment (ACE).

For instance, Global Infrastructure Outlook says that G20 countries committed $3.2tn infrastructure stimulus towards supporting booming populations/industries in 2021 while steel concrete cement bricks, drywalls grassroots are some types of construction materials benefiting from protective coatings which act as barrier against harsh environmental conditions thus preventing rusting/chipping; they are resistant to aggressive detergents or solvents too.

In May 2021, PPG acquired Wörwag, a global coatings manufacturer.

In September 2023, Grasim Industries Limited, a flagship company of the Aditya Birla Group, announced that its paints business would be known as ‘Birla Opus’. The market launch of Birla Opus is scheduled for Q4FY24. In the decorative paints segment, Grasim seeks to provide a full range of high-quality products.

September 2022- WolfRayet deals with powder coating systems and catalytic gas infrared (IR) ovens for powder coating, medium-density fiber (MDF) and other heat-sensitive substrates. Galaxy systems from the company are diverse to cater to various processes.

November 2022- Reactsurf 2490 is an APE-free1 polymerizable surfactant developed as an effective emulsifier for acrylic, vinyl-acrylic, and styrene-acrylic latex systems. In contrast to traditional surfactants used in outdoor coatings and PSAs at elevated temperatures, Reactsurf 2490 improves emulsion performance, leading to enhanced functional & aesthetic benefits.