Market Trends

Key Emerging Trends in the Performance Coatings Market

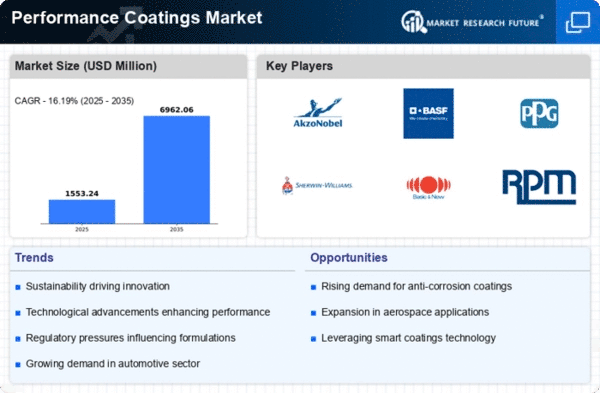

In today's dynamic performance coatings industry, demands driven by industry trends keep shifting, and technological advancements are taking a lead role in driving these changes. One leading trend being witnessed in this area has been a move towards sustainable & environmentally friendly coatings. Manufacturers are gradually adopting innovative formulations aimed at minimizing volatile organic compounds (VOCs) and other harmful chemicals due to environmental concerns becoming more pronounced. Another major trend that is shaping the market dynamics is the growing need for high-performance coatings in different industries, including automotive, aerospace, and industrial applications, among other businesses that use them extensively or have extreme weather conditions. Thus, there is increasing demand for paint offering enhanced longevity as well as resistance against corrosion where applications must endure harsh environments or strong climatic variations, which are not always suitable for all sectors, thereby fueling the expansion of R&D departments tasked with creating new performance-based paints suited particularly well under those circumstances. Technological advancements are crucial factors determining trends across markets, and this holds for the Performance Coatings industry as well. There has been an inclination towards application-based smart coating, which is composed of nanotechnology cooperation enhancing the healing attributes of coats. Their nanoscale particle structures result in improved adhesion, abrasion resistance, and anti-corrosive properties for nanocoatings. The market has shifted towards customization and innovation in general. There is an increasing trend among manufacturers to develop coatings tailored specifically to individual customers' requirements rather than producing generic products that suit all markets. Such a pattern is necessitated by the realization that standard solutions may not always be optimal for diverse industries or applications. Accordingly, firms are undertaking research and development in order to make specialized paints that can solve sector-specific problems, thus ensuring overall improvement of quality. Globalization is also influencing market trends in the Performance Coatings industry. Increasing infrastructure and construction activities in emerging economies are, therefore, driving the demand for high-quality coatings. Additionally, globalization has led to increased integration of the automobile and aerospace sectors, thereby raising the demand for international standard-compliant coating products. Nevertheless, there are still challenges facing this industry, including fluctuating costs of its raw materials inputs such as resins, pigments, and solvents, which change with time due to various reasons. This variability affects the cost of production at large, thereby influencing pricing strategies and margins realized by producers within this sector. As a result, companies have taken up proactive measures such as strategic partnerships and long-term contracts with suppliers so as to insulate themselves from changes in raw material prices.

Leave a Comment