Expanding Global Markets

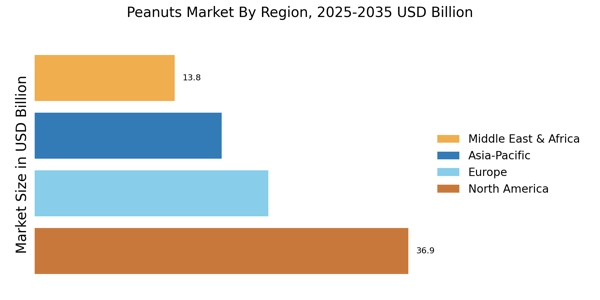

The Peanuts Market is poised for growth as emerging markets present new opportunities for expansion. Countries with increasing populations and rising disposable incomes are likely to drive demand for peanut products. Recent statistics indicate that regions such as Asia and Africa are experiencing significant growth in peanut consumption, fueled by both traditional culinary uses and modern snack trends. This expansion suggests that companies within the Peanuts Market may benefit from targeting these regions with tailored marketing strategies and product offerings. As global trade continues to evolve, the potential for increased exports and market penetration in these developing areas could significantly impact the overall growth trajectory of the Peanuts Market.

Innovative Product Development

Innovation within the Peanuts Market is driving growth as manufacturers explore new product formats and flavors. The introduction of peanut-based snacks, such as protein bars and flavored peanut butter, caters to evolving consumer preferences for convenience and taste. Recent market data indicates that the snack segment is experiencing robust growth, with peanut-based products capturing a notable share. This trend suggests that companies focusing on product innovation are likely to enhance their competitive edge. Furthermore, the development of organic and non-GMO peanut products aligns with consumer demand for transparency and quality, further propelling the Peanuts Market forward. As brands continue to innovate, the potential for market expansion remains substantial.

Sustainability and Ethical Sourcing

Sustainability has emerged as a crucial consideration within the Peanuts Market, as consumers increasingly prioritize ethically sourced products. The demand for sustainable farming practices and environmentally friendly production methods is on the rise. This trend is reflected in the growing interest in organic peanuts and certifications that ensure responsible sourcing. Companies that adopt sustainable practices may enhance their brand reputation and appeal to environmentally conscious consumers. Recent data suggests that products with sustainability certifications are gaining traction, indicating a potential shift in purchasing behavior. As the Peanuts Market adapts to these consumer preferences, the emphasis on sustainability could lead to new opportunities for growth and differentiation.

Rising Demand for Plant-Based Proteins

The increasing consumer shift towards plant-based diets appears to be a significant driver for the Peanuts Market. As more individuals seek alternatives to animal proteins, peanuts, being rich in protein and essential nutrients, are gaining popularity. According to recent data, the demand for plant-based protein sources has surged, with peanuts being a preferred choice due to their versatility and nutritional profile. This trend is likely to continue, as health-conscious consumers increasingly incorporate peanuts into their diets, whether in the form of snacks, spreads, or culinary ingredients. The Peanuts Market is thus positioned to benefit from this growing inclination towards plant-based nutrition, potentially leading to expanded market opportunities and product offerings.

Increased Awareness of Nutritional Benefits

The Peanuts Market is witnessing a surge in consumer awareness regarding the health benefits associated with peanut consumption. Peanuts Market are recognized for their high levels of protein, healthy fats, and various vitamins and minerals, which contribute to overall health. Recent studies have highlighted the role of peanuts in heart health and weight management, leading to increased consumer interest. This heightened awareness is likely to drive demand, as more individuals seek nutritious snack options. Additionally, the Peanuts Market may benefit from educational campaigns that emphasize the health advantages of peanuts, potentially influencing purchasing decisions. As consumers become more informed, the market could see a significant uptick in peanut product sales.