Peanuts Size

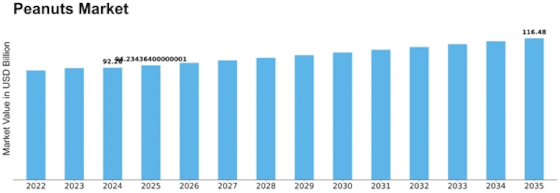

Peanuts Market Growth Projections and Opportunities

Several variables impact the peanut market and demand. Learning about peanuts' health benefits is a major factor. Health-conscious people appreciate peanuts as a snack because they include protein, fiber, and minerals. Peanuts and healthy eating are getting increasingly popular.

Weather and cultivation affect peanut prices. Temperature, humidity, and soil condition impact peanut production. Peanut output may alter during droughts or heavy rainfall, affecting market pricing. Peanut growers monitor the weather and adjust to reduce risks and maintain supply.

The peanut market is impacted by global commerce since large peanut-producing nations trade. Trade accords, taxation, and diplomacy impact peanut imports and exports, affecting pricing and supply. Peanut sellers may face reduced stability and competition due to trade between key peanut-producing nations.

Income and consumer spending determine the peanuts market. Peanuts are inexpensive and accessible, therefore many people enjoy them. People may favor inexpensive peanuts in a poor economy but pricey peanut products in a healthy one.

Changes in diet and flavor affect peanut sales. Peanuts and peanut products are becoming more popular as more people eat plant-based and require protein. Peanut butter, snacks, and flavors make peanuts more versatile. Technology makes peanut cultivation and preparation more efficient and high-quality. Better farming, picking, and precise equipment boost peanut yield and quality. Processing advances allow for safe, high-quality peanut products that fulfill food safety standards.

Health and well-being drive peanut selection. Peanuts offer heart-healthy lipids, minerals as well as vitamins. Peanuts are growing increasingly popular since they are healthy and reduce illness. Peanut companies that tout these health advantages attract customers.

Peanut product availability relies on sales and distribution. You can purchase peanuts at grocery shops, convenience stores, and online. Peanut goods may sell with savvy marketing, solid merchant relationships, and imaginative packaging.

Peanuts are turning greener. People enjoy well-grown and supplied peanuts. Environmentalists like peanut companies that emphasize fair and healthy production and processing.

Nutrition knowledge, weather and agricultural conditions, worldwide commerce, the economy, changing customer preferences, new technology, health concerns, purchasing patterns, and ecologically friendly activities all impact the peanuts market. Peanut farmers must cope with all of these influences to adapt to changing market circumstances, fulfill consumer expectations, and seize new competitive chances.

Leave a Comment