PC Peripherals Market Summary

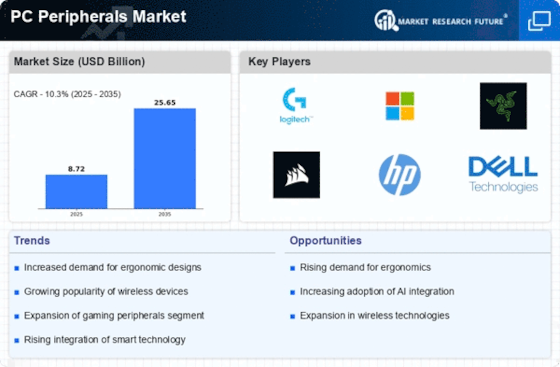

As per Market Research Future analysis, the PC Peripherals Market Size was estimated at 8.723 USD Billion in 2024. The PC Peripherals industry is projected to grow from 9.622 USD Billion in 2025 to 25.65 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 10.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The PC Peripherals Market is experiencing a dynamic evolution driven by technological advancements and changing consumer preferences.

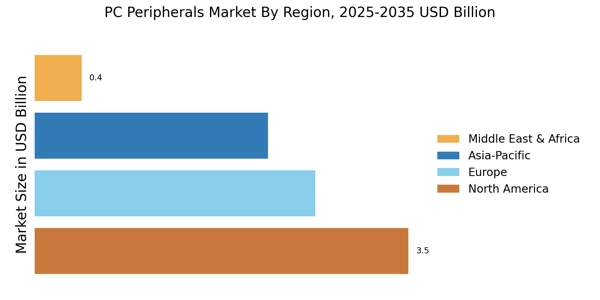

- The focus on ergonomic design is becoming increasingly prevalent, particularly in North America, as consumers prioritize comfort and health.

- Integration of smart technology in peripherals is gaining traction, especially in the Asia-Pacific region, enhancing user experience and functionality.

- Sustainability initiatives are influencing product development, with manufacturers striving to create eco-friendly peripherals that appeal to environmentally conscious consumers.

- Rising demand for remote work solutions and advancements in gaming technology are key drivers, particularly in the PC Peripheral Input Devices segment, which remains the largest in the market.

Market Size & Forecast

| 2024 Market Size | 8.723 (USD Billion) |

| 2035 Market Size | 25.65 (USD Billion) |

| CAGR (2025 - 2035) | 10.3% |

Major Players

Logitech (CH), Microsoft (US), Razer (US), Corsair (US), HP (US), Dell (US), ASUS (TW), Acer (TW), SteelSeries (DK)