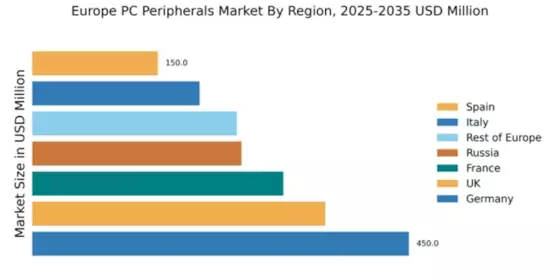

Germany : Strong Demand and Innovation Hub

Germany holds a dominant position in the European PC peripherals market, accounting for 450.0 million, representing approximately 30% of the total market share. Key growth drivers include a robust gaming culture, increasing remote work trends, and a strong emphasis on technological innovation. Government initiatives supporting digital infrastructure and sustainability are also pivotal, enhancing the demand for high-quality peripherals. The country’s advanced industrial base further supports the growth of this sector.

UK : Innovation Meets Consumer Demand

Key markets include London, Manchester, and Birmingham, where demand for gaming peripherals is particularly high. The competitive landscape features major players like Logitech and Razer, alongside local brands. The UK market is characterized by a dynamic business environment, with a strong emphasis on innovation and customer-centric solutions, particularly in gaming and professional sectors.

France : Gaming and Work Drive Demand

Key cities like Paris, Lyon, and Marseille are central to market activity, with a vibrant gaming community driving demand. Major players such as Corsair and SteelSeries have a significant presence, competing in a landscape that values quality and performance. The local market is characterized by a blend of traditional retail and e-commerce, catering to diverse consumer needs across various sectors.

Russia : Growing Demand for Gaming Gear

Moscow and St. Petersburg are the primary markets, showcasing a competitive landscape with both international and local brands. Major players like HyperX and ASUS are establishing a foothold, while local manufacturers are gaining traction. The business environment is evolving, with increasing investment in e-commerce and digital platforms, catering to the growing demand for gaming and professional peripherals.

Italy : Focus on Quality and Design

Key markets include Milan, Rome, and Turin, where demand for stylish and functional peripherals is high. The competitive landscape features brands like Dell and Microsoft, alongside local players. The Italian market is characterized by a strong emphasis on aesthetics and functionality, with a growing trend towards e-commerce and online retailing, particularly in the gaming sector.

Spain : Diverse Applications and Preferences

Key cities like Madrid and Barcelona are central to market dynamics, with a competitive landscape featuring both international and local brands. Major players such as HP and Logitech are well-established, while local companies are emerging. The market is characterized by a blend of traditional retail and online sales, catering to diverse consumer needs across various applications, including gaming and professional use.

Rest of Europe : Emerging Trends Across Regions

Key markets include countries like Sweden, Netherlands, and Belgium, each showcasing unique consumer preferences. The competitive landscape features a mix of international brands and local players, with companies like SteelSeries and Corsair having a significant presence. The business environment is evolving, with increasing investment in e-commerce and digital platforms, catering to the diverse needs of consumers across various sectors.