E-commerce Growth

The rapid expansion of e-commerce is significantly influencing the Paperboard Folding Carton Market. As online shopping continues to gain traction, the demand for efficient and protective packaging solutions has surged. Paperboard folding cartons are favored for their lightweight and customizable nature, making them ideal for shipping a variety of products. Recent data suggests that e-commerce sales have seen remarkable increases, which in turn drives the need for packaging that can withstand transit while appealing to consumers. This trend indicates that the Paperboard Folding Carton Market is poised for growth, as businesses adapt their packaging strategies to meet the evolving demands of online retail.

Customization and Branding

Customization trends are emerging as a significant driver within the Paperboard Folding Carton Market. Brands are increasingly recognizing the importance of unique packaging in differentiating their products in a crowded marketplace. Custom-designed paperboard folding cartons not only enhance brand visibility but also allow for tailored messaging that resonates with target audiences. Market analysis indicates that companies investing in customized packaging solutions are likely to see improved customer engagement and loyalty. This trend suggests that the Paperboard Folding Carton Market will continue to evolve, as businesses seek innovative ways to leverage packaging as a strategic marketing tool.

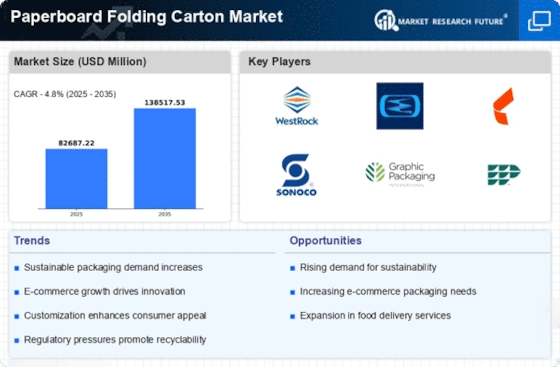

Sustainability Initiatives

The increasing emphasis on sustainability appears to be a pivotal driver for the Paperboard Folding Carton Market. As consumers become more environmentally conscious, companies are compelled to adopt eco-friendly packaging solutions. This shift is reflected in the growing demand for recyclable and biodegradable materials, which are integral to paperboard folding cartons. In fact, the market for sustainable packaging is projected to reach substantial figures, indicating a robust growth trajectory. Furthermore, regulatory frameworks are increasingly favoring sustainable practices, pushing manufacturers to innovate in their packaging solutions. The Paperboard Folding Carton Market is thus likely to benefit from these trends, as businesses seek to align their operations with consumer expectations and regulatory requirements.

Technological Advancements

Technological advancements in manufacturing processes are playing a crucial role in shaping the Paperboard Folding Carton Market. Innovations such as digital printing and automated production lines are enhancing efficiency and reducing costs for manufacturers. These technologies enable the production of high-quality, intricate designs that meet the diverse needs of consumers. Moreover, advancements in materials science are leading to the development of stronger and lighter paperboard options, which can improve the performance of folding cartons. As these technologies continue to evolve, the Paperboard Folding Carton Market is likely to experience increased competitiveness and innovation.

Consumer Preferences for Convenience

Consumer preferences for convenience are increasingly driving the Paperboard Folding Carton Market. As lifestyles become busier, there is a growing demand for packaging that offers ease of use and functionality. Paperboard folding cartons are often designed for easy opening and resealing, catering to the needs of modern consumers. Market trends indicate that products packaged in user-friendly formats tend to perform better in retail settings. This shift in consumer behavior suggests that the Paperboard Folding Carton Market will continue to adapt, focusing on designs that enhance convenience while maintaining aesthetic appeal.