Market Analysis

In-depth Analysis of PAN Based Carbon Fibers Market Industry Landscape

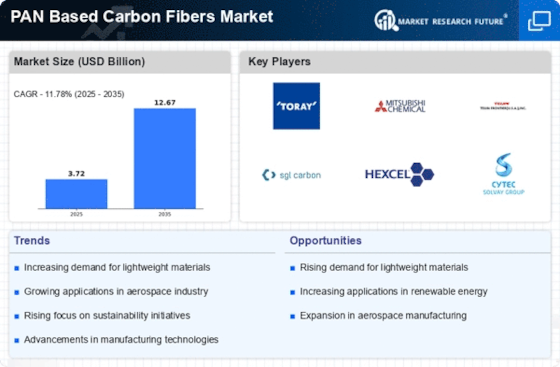

PAN-based Carbon Fibers market dynamics are complex due to a variety of reasons. The increased need for lightweight and high-strength materials across sectors drives this market. PAN-based carbon fibers' high strength-to-weight ratio has made them a popular choice for aerospace, automotive, and sporting goods companies looking to improve performance and fuel efficiency.

Global economic conditions also influence PAN-based carbon fiber market dynamics. Economic indicators like GDP growth affect manufacturing and production, hence the market is sensitive to them. Companies invest more in sophisticated materials like PAN-based carbon fibers during economic growth to improve their products and acquire a competitive edge. Economic downturns may restrict demand as firms cut costs and concentrate vital spending.

Technological improvements also affect PAN-based carbon fiber markets. Continued research and development aims to improve manufacturing methods, lower production costs, and improve fiber performance. Innovations in precursor materials and production methods make PAN-based carbon fibers more accessible to additional industries.

Environmental concerns also influence market dynamics as industries focus more on sustainability and decreasing their environmental impact. PAN-based carbon fibers, which are lightweight and can enhance transportation fuel economy, support worldwide green technology efforts. As environmental regulations change, PAN-based carbon fiber demand may rise.

Also, supply chain dynamics affect the PAN-based Carbon Fibers market. Carbon fiber production costs depend on precursor ingredients, particularly polyacrylonitrile (PAN). Geopolitics, trade policy, and raw material price variations can also cause market uncertainty and supply chain instability. PAN-based carbon fiber companies must carefully negotiate these issues to stay competitive and secure material availability.

Competition is shaped by product innovation, pricing strategies, and market penetration. Major players spend in R&D to introduce new and improved PAN-based carbon fiber products, improving performance and cost. Companies often form strategic partnerships to expand their market share and consumer base.

Finally, technological advances, economic conditions, environmental concerns, and supply chain dynamics affect the PAN-based Carbon Fibers market. Demand for PAN-based carbon fibers will rise as sectors emphasize lightweight, high-strength materials.

Leave a Comment