Expansion of Renewable Energy Sector

The Oxidized PAN fibers Market is benefiting from the expansion of the renewable energy sector, particularly in wind energy applications. The use of oxidized PAN fibers in the production of lightweight and durable components for wind turbine blades is becoming more prevalent. This trend aligns with the global push towards renewable energy sources, which is projected to grow at a rate of approximately 8% annually. As countries invest in sustainable energy solutions, the demand for materials that enhance the efficiency and longevity of wind turbines is likely to increase. Consequently, the incorporation of oxidized PAN fibers in this sector is expected to drive market growth.

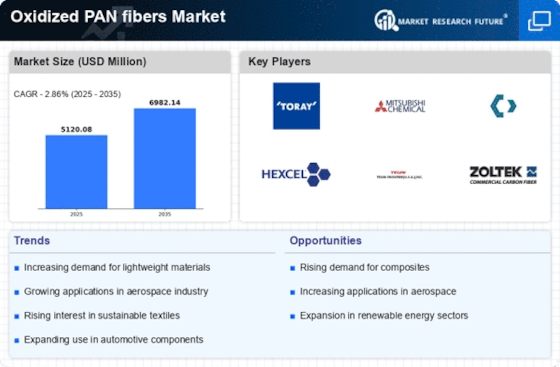

Rising Demand for Lightweight Materials

The Oxidized PAN fibers Market is experiencing growth driven by the rising demand for lightweight materials across various sectors. The aerospace and automotive industries are particularly focused on reducing weight to enhance fuel efficiency and performance. Oxidized PAN fibers Market, known for their lightweight yet strong characteristics, are increasingly being utilized in composite materials. This shift is supported by data indicating that lightweight materials can improve fuel efficiency by up to 20%. As manufacturers seek to meet stringent environmental regulations and consumer preferences for sustainable products, the incorporation of oxidized PAN fibers is expected to rise, thereby propelling market growth.

Growing Awareness of Environmental Impact

The Oxidized PAN fibers Market is influenced by the growing awareness of environmental impact among consumers and manufacturers alike. As sustainability becomes a critical focus, industries are increasingly seeking eco-friendly materials. Oxidized PAN fibers Market, which can be produced with lower environmental footprints compared to traditional fibers, are gaining traction. This shift is reflected in market trends, where eco-conscious consumers are driving demand for sustainable products. Reports indicate that the market for sustainable materials is expected to grow by over 10% annually. As companies strive to align with consumer preferences and regulatory requirements, the adoption of oxidized PAN fibers is likely to increase, further stimulating market growth.

Technological Innovations in Fiber Production

The Oxidized PAN fibers Market is poised for growth due to ongoing technological innovations in fiber production processes. Advances in manufacturing techniques, such as improved oxidation methods and enhanced spinning technologies, are leading to higher quality oxidized PAN fibers with better performance characteristics. These innovations not only increase production efficiency but also reduce costs, making oxidized PAN fibers more accessible to various industries. Market data suggests that the introduction of new production technologies could potentially increase the market size by 15% over the next five years. As manufacturers adopt these advancements, the overall competitiveness of the oxidized PAN fibers market is likely to improve.

Increasing Applications in Fire-Resistant Materials

The Oxidized PAN fibers Market is witnessing a notable surge in demand due to the increasing applications of these fibers in fire-resistant materials. Industries such as construction and automotive are increasingly adopting oxidized PAN fibers for their superior thermal stability and flame-retardant properties. This trend is particularly evident in the development of protective clothing and insulation materials, where safety standards are paramount. The market for fire-resistant materials is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 5% in the coming years. As regulations tighten around fire safety, the adoption of oxidized PAN fibers is likely to expand, further driving the market.