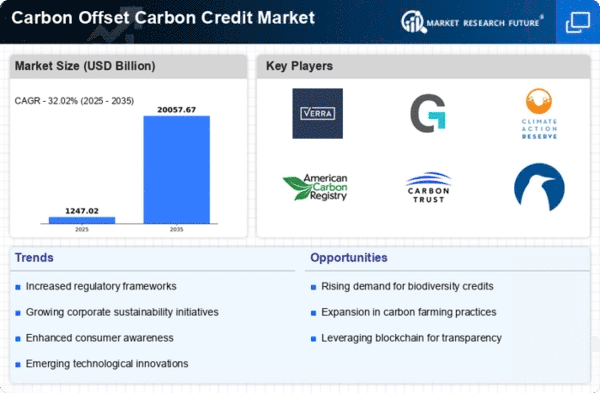

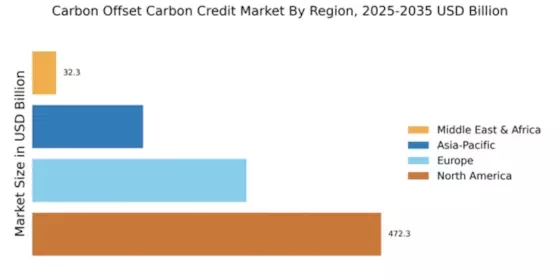

North America : Market Leader in Carbon Credits

North America is poised to maintain its leadership in the Carbon Offset Carbon Credit Market, holding a significant market share of 472.29M in 2025. The region's growth is driven by stringent regulatory frameworks, increasing corporate sustainability commitments, and a growing demand for carbon credits among businesses aiming to offset their emissions. The U.S. government has implemented various initiatives to promote carbon neutrality, further fueling market expansion. The competitive landscape is robust, with key players such as Verra, Climate Action Reserve, and American Carbon Registry leading the charge. The U.S. is the primary market, supported by innovative projects and a strong emphasis on transparency and verification. As companies increasingly seek to enhance their environmental credentials, the demand for carbon credits is expected to rise, solidifying North America's position as a market powerhouse.

Europe : Sustainable Growth and Innovation

Europe is emerging as a significant player in the Carbon Offset Carbon Credit Market, with a market size of 290.0M in 2025. The region's growth is propelled by ambitious climate targets set by the European Union, aiming for a 55% reduction in greenhouse gas emissions by 2030. This regulatory push, combined with increasing public awareness and corporate responsibility, is driving demand for carbon credits across various sectors. Leading countries such as Germany, France, and the UK are at the forefront of this market, supported by organizations like Gold Standard and Carbon Trust. The competitive landscape is characterized by a mix of established players and innovative startups, all striving to meet the growing demand for sustainable solutions. As Europe continues to prioritize environmental sustainability, the carbon credit market is expected to flourish, attracting investments and fostering innovation.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing a burgeoning interest in the Carbon Offset Carbon Credit Market, with a market size of 150.0M in 2025. This growth is driven by increasing industrialization, urbanization, and a rising awareness of climate change impacts. Governments in countries like China and India are implementing policies to promote carbon trading and offset initiatives, creating a favorable environment for market expansion. China is leading the charge, with significant investments in renewable energy and carbon offset projects. The competitive landscape includes key players such as South Pole and EcoAct, who are actively engaging with local businesses to develop tailored carbon credit solutions. As the region continues to embrace sustainability, the demand for carbon credits is expected to rise, positioning Asia-Pacific as a vital player in the global market.

Middle East and Africa : Emerging Opportunities Ahead

The Middle East and Africa region is gradually entering the Carbon Offset Carbon Credit Market, with a market size of 32.28M in 2025. The growth is primarily driven by increasing awareness of climate change and the need for sustainable development. Governments are beginning to recognize the importance of carbon credits as a tool for achieving environmental goals, leading to the establishment of regulatory frameworks that support market growth. Countries like South Africa and the UAE are taking the lead in developing carbon offset projects, supported by international organizations. The competitive landscape is still in its infancy, with a few key players starting to emerge. As the region continues to explore sustainable practices, the carbon credit market is expected to gain traction, presenting new opportunities for investment and collaboration.