Regulatory Compliance

Regulatory compliance is a significant driver impacting the Pag Base Stock Market. Stricter environmental regulations and safety standards are compelling manufacturers to reformulate their products. Compliance with these regulations often necessitates the development of base stocks that are less harmful to the environment and human health. In 2025, it is anticipated that compliance-related costs will influence pricing strategies, as companies invest in meeting these standards. This regulatory landscape is likely to create opportunities for manufacturers who can innovate and provide compliant products. As a result, the Pag Base Stock Market is expected to see a shift towards more sustainable and safer formulations, aligning with global regulatory trends.

Technological Innovations

Technological advancements are a pivotal driver in the Pag Base Stock Market. The integration of advanced manufacturing techniques, such as nanotechnology and artificial intelligence, is enhancing product quality and performance. These innovations enable the production of base stocks with superior thermal stability and reduced volatility, catering to the evolving needs of various applications. In 2025, the market is expected to witness a surge in the adoption of synthetic base stocks, which are engineered to provide enhanced lubrication properties. This shift is likely to result in a market growth rate of around 10% annually, as industries seek high-performance lubricants that can withstand extreme conditions. Consequently, companies that leverage these technologies are positioned to gain a competitive edge in the Pag Base Stock Market.

Sustainability Initiatives

The Pag Base Stock Market is increasingly influenced by sustainability initiatives. Companies are prioritizing eco-friendly practices, which is reshaping product development and manufacturing processes. The demand for biodegradable and renewable base stocks is on the rise, as consumers and regulatory bodies push for greener alternatives. In 2025, the market for sustainable lubricants is projected to grow by approximately 15%, reflecting a shift towards environmentally responsible products. This trend not only enhances brand reputation but also aligns with global efforts to reduce carbon footprints. As a result, manufacturers in the Pag Base Stock Market are investing in research and development to create innovative, sustainable solutions that meet both performance and environmental standards.

Market Expansion in Emerging Economies

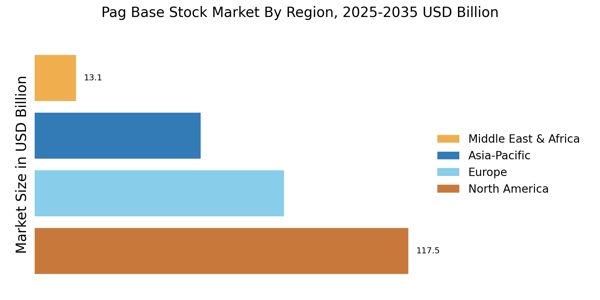

The Pag Base Stock Market is poised for expansion in emerging economies, where industrialization and urbanization are driving lubricant demand. Countries in Asia and Africa are witnessing rapid growth in automotive and manufacturing sectors, leading to increased consumption of base stocks. In 2025, it is projected that these regions will contribute significantly to the overall market growth, with an estimated increase of 20% in lubricant demand. This trend presents opportunities for manufacturers to establish a presence in these markets, catering to the specific needs of local industries. As companies adapt their strategies to penetrate these emerging markets, the Pag Base Stock Market is likely to experience a transformation, characterized by localized product offerings and tailored marketing approaches.

Rising Demand for High-Performance Lubricants

The Pag Base Stock Market is experiencing a notable increase in demand for high-performance lubricants. Industries such as automotive, aerospace, and manufacturing are seeking lubricants that offer superior protection and efficiency. This trend is driven by the need for enhanced performance in machinery and vehicles, which is critical for reducing downtime and maintenance costs. In 2025, the high-performance lubricant segment is projected to account for over 40% of the total market share, indicating a robust growth trajectory. As manufacturers respond to this demand, they are focusing on developing base stocks that can deliver exceptional performance under extreme conditions. This shift not only benefits end-users but also propels innovation within the Pag Base Stock Market.