Increasing Urbanization

The trend of increasing urbanization appears to be a pivotal driver for the Rolling Stock Market. As populations migrate towards urban centers, the demand for efficient public transportation systems intensifies. This shift necessitates the expansion and modernization of rail networks, thereby propelling investments in rolling stock. According to recent data, urban areas are expected to house approximately 68% of the world's population by 2050, which could lead to a substantial increase in the need for commuter trains and light rail systems. Consequently, manufacturers in the Rolling Stock Market are likely to focus on developing innovative solutions to meet the rising demand for urban transit options.

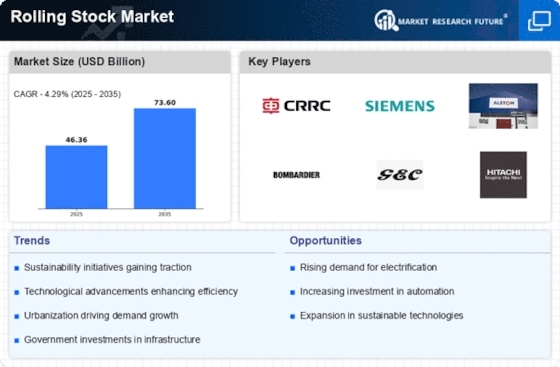

Technological Innovations

Technological innovations are transforming the Rolling Stock Market, presenting both opportunities and challenges. The integration of advanced technologies such as automation, artificial intelligence, and IoT is enhancing the efficiency and safety of rail operations. For example, predictive maintenance technologies are being adopted to minimize downtime and optimize performance. Furthermore, the market for smart trains is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This technological evolution is likely to drive manufacturers to invest in research and development, ensuring that the Rolling Stock Market remains competitive and responsive to emerging trends.

Freight Transportation Demand

The rising demand for freight transportation is emerging as a significant driver for the Rolling Stock Market. With the growth of e-commerce and global trade, the need for efficient freight solutions is becoming increasingly apparent. Recent statistics suggest that freight rail traffic is projected to increase by approximately 30% over the next decade, necessitating the expansion of freight rolling stock. This surge in demand is likely to encourage manufacturers to innovate and diversify their offerings, including the development of specialized freight cars. As logistics companies seek to optimize their supply chains, the Rolling Stock Market is poised to benefit from this upward trend in freight transportation.

Environmental Regulations and Sustainability

Environmental regulations and sustainability initiatives are increasingly influencing the Rolling Stock Market. Governments and regulatory bodies are imposing stricter emissions standards, prompting manufacturers to develop greener rolling stock solutions. The shift towards electric and hybrid trains is gaining momentum, as these options align with global sustainability goals. Recent data indicates that the market for electric trains is expected to grow at a compound annual growth rate of around 8% over the next decade. This trend not only addresses environmental concerns but also enhances operational efficiency, making it a critical driver for the Rolling Stock Market as stakeholders seek to balance performance with ecological responsibility.

Government Investments in Rail Infrastructure

Government investments in rail infrastructure are likely to play a crucial role in shaping the Rolling Stock Market. Many governments are prioritizing the enhancement of rail networks to improve connectivity and reduce congestion. For instance, recent reports indicate that several countries have allocated significant budgets for rail projects, with investments projected to reach over 200 billion dollars in the next five years. This influx of capital is expected to stimulate the demand for new rolling stock, including high-speed trains and freight cars, as governments seek to modernize their transportation systems. Such initiatives not only enhance operational efficiency but also contribute to economic growth, thereby reinforcing the importance of the Rolling Stock Market.