Research Methodology on Rolling Stock Market

1. Introduction

This research report is aimed at exploring the trends influencing the rolling stock market, which is a subset of the much broader transportation equipment industry. To carry out the research, Market Research Future (MRFR) employed a multifaceted approach to understanding the trends defining the rolling stock market over the review period 2023-2030. The primary objective of the research is to provide an industry-level assessment of the rolling stock market and expand the understanding of the sector to participants within the industry, existing and potential investors, and regulatory bodies.

To achieve the objectives of the research report, MRFR employed a two-phased approach to carry out the market assessment: comprehensive secondary research and primary research. The first phase incorporated data points collected from industry sources such as databases, surveys and published industry reports. Since there are limited publicly available data points within the rolling stock market segment, the primary research phase was particularly important in order to fill the data gap and provide accurate information about the various segments of the rolling stock market. Data collated from secondary sources were triangulated with feedback from industry participants. The approach involves semi-structured interviews with C-level participants from stakeholder organisations within the rolling stock industry.

2. Research Approach

The MRFR research approach involves:

2.1 Secondary Research

Visible sources of information such as reports, journals, and other resources were used to provide accurate and detailed market assessments. Information gathered from other publicly available sources was explicitly analyzed and verified as and where necessary. Sources used during the secondary research phase included, but were not limited to:

-Industry white papers

-Government documents or websites

-Market reports by respected paid consulting firms

-IEEE Journals, particularly related to transportation equipment development

-Reports on railway transportation

-Society of Automotive Engineers

-Associations related to railways

2.2 Primary Research

Semi-structured interviews with C-level participants from stakeholder organisations within the rolling stock sector provided insights into current trends and market developments. Two rounds of semi-structured interviews were conducted in sequence to ensure qualitative market assessments. The first round of interviews was aimed at collecting data for scoping the primary market; whilst the second round of interviews provided supplemental data for triangulating information gathered from other sources.

3. Market Segmentation and Scope

The rolling stock market is segmented according to type, end-user and geography.

3.1 By Type

The rolling stock sector is segmented by type into trains, trams, and others.

3.2 By End-User

The end-users covered in this report are mass transit and freight

3.3 By Geography

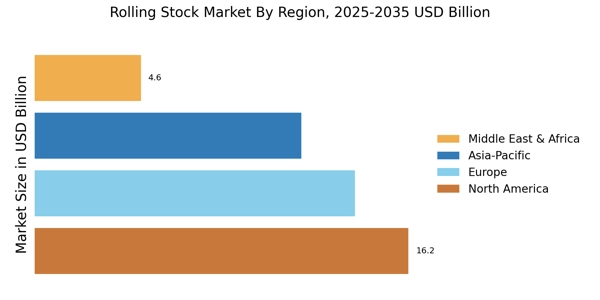

The market is analysed across North America, Europe, Asia-Pacific, and the rest of the world (RoW)

4. Assumptions

The rolling stock market assessment was based on the assumption that the sector will continue to experience steady growth and technological advances. Moreover, it is assumed that governments around the globe will continue to invest in strengthening the railway infrastructure, which will in turn lead to significant investments in rolling stock.

5. Research Process

MRFR's research process involves actively engaging industry participants to ensure the accuracy of information. A 3-step approach was followed to understand the trends and challenges within the rolling stock market:

5.1 Identification of Parameters Influencing the Market

To examine the trends influencing the rolling stock market, information points on the current and potential challenges within the sector were collected. The data points were identified based on the objectives of the research and were specific to different regions.

5.2 Synthesis of Secondary Sources

The secondary research phase involved the extensive use of libraries, archives and databases to collate information useful for the research. The data collected from secondary sources were used to understand the trends and challenges within the rolling stock market and the current and potential investment areas within the sector.

5.3 Primary Market Data Analysis

The primary research phase includes semi-structured interviews with C-level participants from stakeholder organisations within the rolling stock industry. The semi-structured interviews were conducted over a period of time to collect meaningful and accurate data about the rolling stock market. The primary research phase was significant in understanding the current and potential challenges within the sector, as it provides unfiltered opinions from industry participants.

6. Conclusion

This research report aims at understanding the trends influencing the rolling stock market. To achieve this objective, MRFR used a research approach involving comprehensive secondary research and primary research. Secondary research entailed the use of databases, reports and other publicly available data sources. Whilst the primary research phase involved engaging with industry participants through semi-structured interviews. Both research phases were used to collate data for understanding the various aspects of the rolling stock market. It is hoped that this report would be of value to players within the sector, existing and potential investors, and regulatory bodies.