E-commerce Growth

The rapid growth of e-commerce is significantly impacting the Packaging Primers Market, as online retailers seek innovative packaging solutions to enhance customer experience. With the increase in online shopping, there is a heightened demand for packaging that ensures product safety during transit while also appealing to consumers upon delivery. This trend has led to the development of packaging primers that are not only functional but also aesthetically pleasing. Market data indicates that e-commerce sales are expected to continue their upward trajectory, which will likely drive further innovation in packaging solutions. Companies that adapt to the needs of the e-commerce sector may find new opportunities for growth within the Packaging Primers Market.

Customization Trends

The demand for customization in the Packaging Primers Market is on the rise, as brands seek to differentiate themselves in a crowded marketplace. Customization allows companies to tailor their packaging solutions to meet specific consumer needs and preferences. This trend is particularly evident in sectors such as cosmetics and food, where unique packaging can enhance brand identity and consumer engagement. Industry expert's suggests that customized packaging solutions can lead to a 20% increase in customer satisfaction and loyalty. As brands continue to prioritize personalized experiences, the Packaging Primers Market is expected to see a surge in demand for customizable packaging options.

Regulatory Compliance

Regulatory compliance is becoming increasingly critical in the Packaging Primers Market, as governments worldwide implement stricter regulations regarding packaging materials and safety standards. Companies must navigate a complex landscape of regulations to ensure their products meet legal requirements. This compliance not only affects product design but also influences material selection and production processes. Failure to adhere to these regulations can result in significant financial penalties and damage to brand reputation. As a result, companies that proactively engage with regulatory changes are likely to maintain a competitive advantage in the Packaging Primers Market. The ongoing evolution of regulations suggests that staying informed and adaptable will be essential for success.

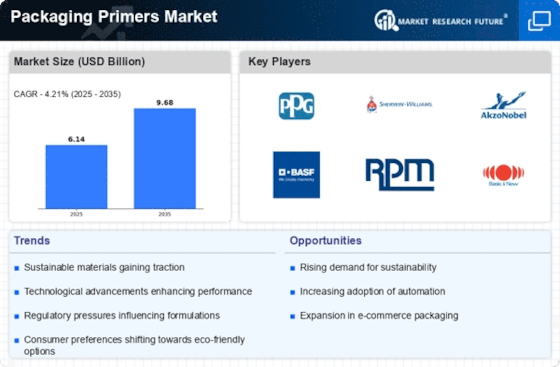

Technological Innovations

Technological advancements are reshaping the Packaging Primers Market, leading to enhanced product performance and efficiency. Innovations such as advanced coating technologies and smart packaging solutions are becoming increasingly prevalent. These technologies not only improve the durability and functionality of packaging primers but also contribute to cost reductions in manufacturing processes. For instance, the integration of automation and artificial intelligence in production lines has shown to increase output while minimizing errors. Market data indicates that the adoption of such technologies could potentially lead to a 15% increase in production efficiency. As a result, companies that invest in technological innovations are likely to see improved market positioning within the Packaging Primers Market.

Sustainability Initiatives

The increasing emphasis on sustainability within the Packaging Primers Market is driving demand for eco-friendly products. Companies are increasingly adopting sustainable practices, such as using biodegradable materials and reducing waste in production processes. This shift is not merely a trend; it reflects a broader societal movement towards environmental responsibility. As consumers become more environmentally conscious, they are likely to prefer products that align with their values. According to recent data, the market for sustainable packaging is projected to grow significantly, indicating a strong correlation between sustainability initiatives and market growth. This trend suggests that companies focusing on sustainable packaging solutions may gain a competitive edge in the Packaging Primers Market.