E-commerce Growth

The rise of e-commerce has profoundly impacted the Global Packaging Market Industry, necessitating innovative packaging solutions that ensure product safety during transit. With online shopping becoming increasingly prevalent, packaging must adapt to protect goods while also appealing to consumers. The demand for protective packaging materials, such as bubble wrap and corrugated boxes, is on the rise. This trend is expected to contribute to the market's growth, as e-commerce sales continue to surge. By 2035, the market is projected to reach 805.3 USD Billion, indicating the significant role e-commerce plays in shaping packaging requirements.

Consumer Preferences

Consumer preferences play a pivotal role in shaping the Global Packaging as buyers increasingly seek convenience, functionality, and aesthetic appeal in packaging. The demand for user-friendly packaging, such as resealable bags and easy-to-open containers, reflects this trend. Additionally, consumers are becoming more conscious of the environmental impact of packaging, leading to a preference for sustainable options. Companies that effectively respond to these preferences are likely to enhance their market position. As the industry adapts to these changing consumer demands, it is poised for growth, contributing to the projected market value of 549.1 USD Billion in 2024.

Regulatory Compliance

Regulatory compliance is a critical driver in the Global Packaging Market Industry, as governments worldwide implement stricter regulations regarding packaging materials and waste management. Companies must navigate these regulations to avoid penalties and maintain market access. For instance, regulations promoting the use of recyclable materials are prompting manufacturers to innovate and adapt their packaging solutions. This compliance not only ensures legal adherence but also aligns with consumer expectations for sustainable practices. As the industry evolves, adherence to these regulations is likely to shape packaging strategies, influencing market dynamics and growth.

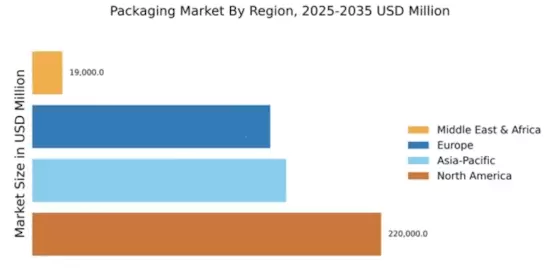

Market Growth Projections

The Global Packaging Industry size is projected to experience substantial growth, with estimates indicating a market value of 549.1 USD Billion in 2024 and an anticipated increase to 805.3 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 3.54% from 2025 to 2035. Various factors, including sustainability initiatives, e-commerce expansion, and technological advancements, are likely to drive this growth. As the industry evolves, it is essential to monitor these trends to understand their implications for market dynamics and investment opportunities.

Sustainability Initiatives

The Global Packaging Market Industry is increasingly influenced by sustainability initiatives as consumers and companies alike prioritize eco-friendly practices. This shift is evident in the growing demand for biodegradable and recyclable materials, which are projected to drive market growth. For instance, many companies are adopting sustainable packaging solutions to align with consumer preferences, which could potentially enhance brand loyalty. As a result, the industry is expected to witness a significant transformation, with sustainable packaging solutions becoming a standard rather than an exception. This trend is likely to contribute to the market's projected value of 549.1 USD Billion in 2024.

Technological Advancements

Technological advancements are reshaping the Global Packaging Market Industry by introducing innovative materials and processes that enhance efficiency and reduce costs. Automation in packaging processes, such as robotic packing and smart packaging technologies, is becoming increasingly common. These advancements not only improve production efficiency but also enhance the consumer experience through features like QR codes and interactive packaging. As companies invest in these technologies, they are likely to gain a competitive edge, driving market growth. The anticipated compound annual growth rate of 3.54% from 2025 to 2035 underscores the importance of technology in the evolving packaging landscape.