Rising Demand in Construction Sector

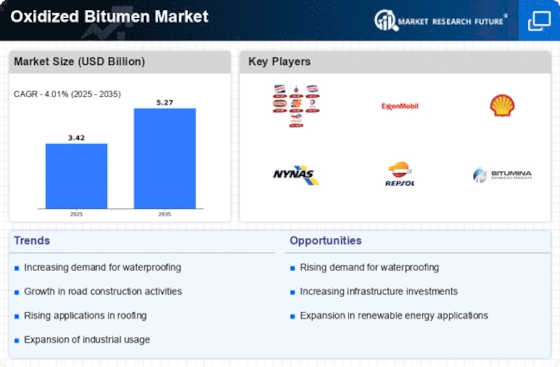

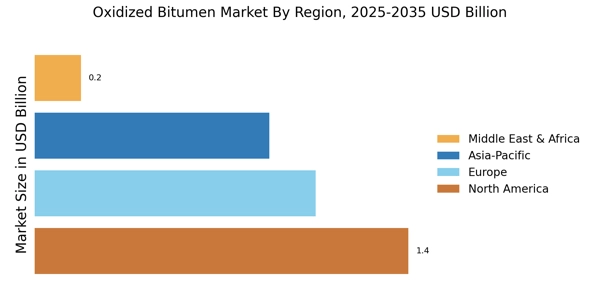

The Oxidized Bitumen Market is experiencing a notable surge in demand, primarily driven by the construction sector. As urbanization accelerates, the need for durable and high-performance materials in road construction and roofing applications becomes increasingly critical. In 2025, the construction industry is projected to grow at a compound annual growth rate of approximately 5.5%, which directly influences the consumption of oxidized bitumen. This material is favored for its excellent waterproofing properties and resistance to extreme weather conditions, making it a preferred choice for various construction projects. Furthermore, the expansion of infrastructure projects, particularly in developing regions, is likely to bolster the demand for oxidized bitumen, thereby enhancing its market presence.

Growing Focus on Sustainable Materials

The Oxidized Bitumen Market is witnessing a shift towards sustainable construction practices. As environmental concerns gain prominence, there is an increasing emphasis on using materials that minimize ecological impact. Oxidized bitumen, known for its recyclability and low emissions during production, aligns well with these sustainability initiatives. In recent years, several countries have implemented regulations encouraging the use of eco-friendly materials in construction. This trend is expected to drive the demand for oxidized bitumen, as it offers a viable alternative to traditional materials. The market is likely to benefit from innovations aimed at enhancing the sustainability of oxidized bitumen products, potentially leading to a broader acceptance in various applications.

Technological Innovations in Production

The Oxidized Bitumen Market is significantly influenced by advancements in production technologies. Innovations such as improved oxidation processes and the development of high-performance oxidized bitumen products are reshaping the market landscape. These technological enhancements not only increase the efficiency of production but also improve the quality and performance characteristics of oxidized bitumen. For instance, the introduction of modified oxidized bitumen has expanded its application range, making it suitable for more demanding environments. As manufacturers continue to invest in research and development, the market is likely to see a rise in product offerings that cater to specific industry needs, thereby driving overall market growth.

Increasing Applications in Waterproofing

The Oxidized Bitumen Market is benefiting from the increasing applications of oxidized bitumen in waterproofing solutions. As the construction industry evolves, the need for effective waterproofing materials has become paramount. Oxidized bitumen is recognized for its excellent waterproofing properties, making it a preferred choice for roofing and foundation applications. The market is likely to see a rise in demand as more construction projects prioritize moisture protection to enhance building longevity. Additionally, the growing trend of green building practices is expected to further drive the adoption of oxidized bitumen in waterproofing applications, as it offers a reliable solution that meets both performance and environmental standards.

Expansion of Road Infrastructure Projects

The Oxidized Bitumen Market is poised for growth due to the expansion of road infrastructure projects. Governments across various regions are investing heavily in upgrading and expanding their road networks to accommodate increasing traffic and enhance connectivity. This trend is particularly evident in emerging economies, where infrastructure development is a priority. The demand for oxidized bitumen is expected to rise as it is a critical component in road construction, providing durability and longevity to pavements. In 2025, the road construction sector is anticipated to witness a significant increase in investment, further propelling the demand for oxidized bitumen and solidifying its role in infrastructure development.