Technological Innovations

Technological advancements in the formulation and application of bitumen emulsifiers are likely to propel the Bitumen Emulsifiers Market forward. Innovations such as the development of high-performance emulsifiers that enhance adhesion and durability are becoming increasingly prevalent. These advancements enable the production of more efficient and cost-effective emulsions, which are essential for modern road construction and maintenance. The market is witnessing a surge in research and development activities aimed at improving the performance characteristics of bitumen emulsifiers. As a result, the industry is expected to experience a notable increase in demand, with projections indicating a market size reaching several billion dollars by the end of the decade.

Infrastructure Development

The ongoing infrastructure development projects across various regions are contributing significantly to the growth of the Bitumen Emulsifiers Market. Governments are investing heavily in road construction and maintenance to enhance connectivity and support economic growth. This trend is particularly evident in developing regions, where infrastructure is being prioritized to facilitate trade and mobility. The demand for bitumen emulsifiers is expected to rise in tandem with these projects, as they are essential for producing high-quality asphalt mixtures. Market analysts suggest that the infrastructure sector could account for a substantial share of the overall bitumen emulsifiers market, potentially exceeding 30% in the coming years.

Sustainability Initiatives

The increasing emphasis on sustainability within the construction and road maintenance sectors appears to be a pivotal driver for the Bitumen Emulsifiers Market. As environmental regulations tighten, companies are compelled to adopt eco-friendly materials and practices. Bitumen emulsifiers, known for their lower environmental impact compared to traditional bitumen, are gaining traction. The market for these emulsifiers is projected to grow at a compound annual growth rate of approximately 5% over the next few years, driven by the demand for sustainable construction solutions. This shift not only aligns with regulatory requirements but also meets the expectations of environmentally conscious consumers, thereby enhancing the market's appeal.

Emerging Market Opportunities

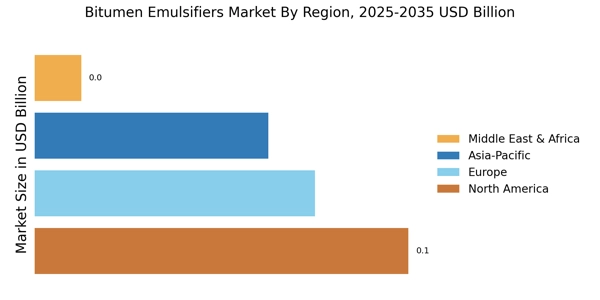

Emerging markets are presenting new opportunities for the Bitumen Emulsifiers Market, as urbanization and industrialization continue to accelerate. Countries experiencing rapid economic growth are investing in infrastructure development, which in turn drives the demand for bitumen emulsifiers. The construction of new roads, highways, and urban infrastructure projects necessitates the use of high-quality emulsifiers to ensure durability and performance. Market forecasts indicate that regions such as Asia-Pacific and Latin America could see a significant increase in market share, potentially reaching over 25% by the end of the decade. This trend underscores the importance of targeting emerging markets to capitalize on the growing demand for bitumen emulsifiers.

Rising Demand for Road Maintenance

The increasing need for road maintenance and rehabilitation is emerging as a crucial driver for the Bitumen Emulsifiers Market. Aging infrastructure in many regions necessitates the use of effective materials that can extend the lifespan of roads. Bitumen emulsifiers play a vital role in the maintenance of asphalt surfaces, providing enhanced adhesion and flexibility. As governments and private entities allocate more resources towards maintaining existing road networks, the demand for bitumen emulsifiers is expected to rise. This trend is likely to result in a market expansion, with estimates suggesting a growth rate of around 4% annually over the next few years, reflecting the critical role of these emulsifiers in road preservation.