Emergence of Targeted Therapies

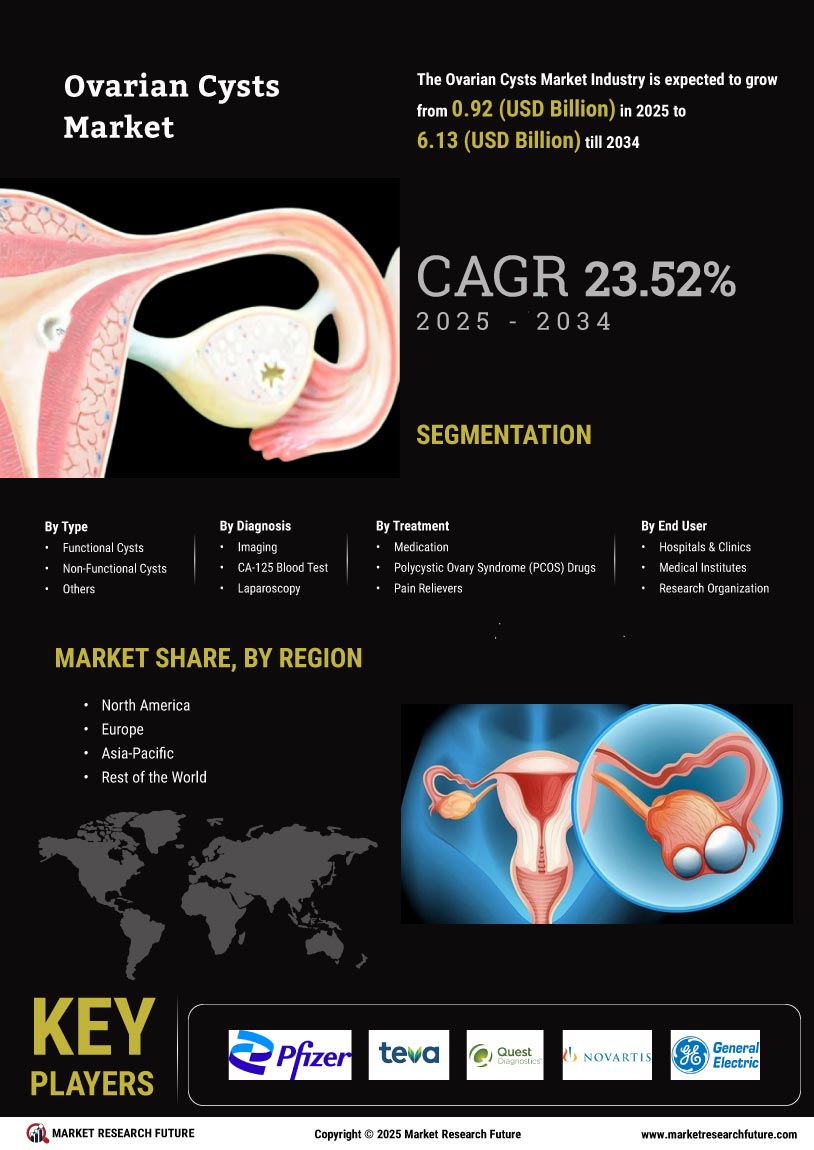

The emergence of targeted therapies for ovarian cysts marks a transformative phase in the Global Ovarian Cysts Market Industry. These therapies aim to address the underlying causes of cyst formation, offering patients more effective treatment options. As research progresses, the development of personalized medicine tailored to individual patient profiles is becoming increasingly feasible. This shift towards targeted therapies is expected to enhance treatment efficacy and patient satisfaction, contributing to a projected market value of 7.57 USD Billion by 2035. The Global Ovarian Cysts Market Industry is likely to witness significant advancements as these therapies gain traction.

Growing Awareness and Education

There is a marked increase in awareness and education regarding ovarian health, which plays a crucial role in the Global Ovarian Cysts Market Industry. Campaigns aimed at educating women about the symptoms and risks associated with ovarian cysts are gaining traction. This heightened awareness encourages women to seek medical advice promptly, leading to early diagnosis and treatment. Consequently, the market is likely to experience a compound annual growth rate (CAGR) of 23.54% from 2025 to 2035. As educational initiatives continue to proliferate, the Global Ovarian Cysts Market Industry is expected to thrive.

Increased Healthcare Expenditure

The Global Ovarian Cysts Market Industry benefits from the rising healthcare expenditure observed globally. Governments and private sectors are investing significantly in healthcare infrastructure, which includes the treatment of ovarian conditions. This increase in funding facilitates access to advanced treatment options and improves patient care. As healthcare systems evolve, the market is projected to grow, reaching an estimated value of 0.74 USD Billion in 2024. The focus on women's health initiatives further underscores the importance of addressing ovarian cysts, thereby propelling the Global Ovarian Cysts Market Industry forward.

Rising Incidence of Ovarian Cysts

The Global Ovarian Cysts Market Industry experiences a notable increase in the incidence of ovarian cysts, which is primarily attributed to factors such as hormonal imbalances and lifestyle changes. Reports indicate that approximately 10% of women of reproductive age are affected by ovarian cysts, leading to heightened awareness and demand for medical interventions. This growing prevalence is expected to drive the market, with projections suggesting that the market will reach 0.74 USD Billion in 2024. As healthcare providers focus on early diagnosis and treatment, the Global Ovarian Cysts Market Industry is poised for substantial growth.

Advancements in Diagnostic Techniques

Technological advancements in diagnostic techniques significantly influence the Global Ovarian Cysts Market Industry. Innovations such as transvaginal ultrasound and MRI enhance the accuracy of ovarian cyst detection, facilitating timely intervention. These advancements not only improve patient outcomes but also contribute to increased healthcare expenditure on diagnostic services. As a result, the market is projected to expand, with an anticipated value of 7.57 USD Billion by 2035. The integration of artificial intelligence in imaging techniques further streamlines the diagnostic process, indicating a promising future for the Global Ovarian Cysts Market Industry.