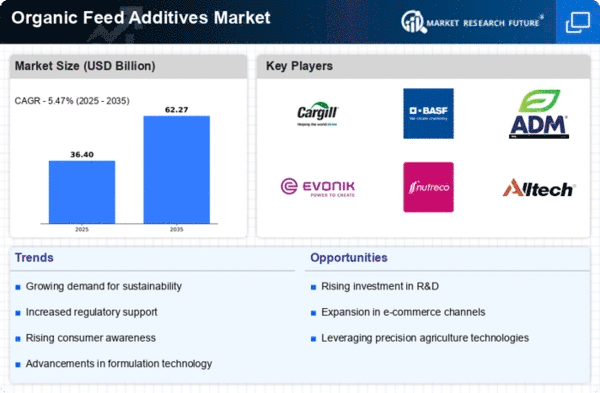

Market Growth Projections

The Global Organic Feed Additives Industry is poised for substantial growth, with projections indicating a market value of 34.0 USD Billion in 2024 and an anticipated increase to 57.5 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 4.89% from 2025 to 2035, reflecting the increasing adoption of organic practices in livestock production. The market dynamics are influenced by various factors, including consumer preferences, regulatory frameworks, and technological advancements, all contributing to a robust outlook for organic feed additives.

Regulatory Support for Organic Farming

Government regulations and policies favoring organic farming practices significantly bolster the Global Organic Feed Additives Industry. Many countries are implementing stricter regulations on chemical feed additives, thereby encouraging farmers to transition to organic alternatives. This regulatory landscape not only promotes the use of organic feed additives but also enhances consumer trust in organic products. As a result, the market is likely to witness sustained growth, aligning with the increasing number of organic certifications and standards being established globally. Such regulatory support is pivotal in shaping the future of organic feed additives.

Health Benefits of Organic Feed Additives

The health benefits associated with organic feed additives are becoming increasingly recognized within the Global Organic Feed Additives Industry. These additives are known to enhance animal health, improve nutrient absorption, and reduce the incidence of diseases. For instance, organic acids and probiotics are widely used to promote gut health in livestock, leading to better overall productivity. As awareness of these benefits spreads among farmers and consumers alike, the demand for organic feed additives is expected to rise. This trend aligns with the broader movement towards healthier food systems and sustainable agricultural practices.

Sustainability and Environmental Concerns

Sustainability and environmental concerns are driving forces behind the growth of the Global Organic Feed Additives Industry. As the agricultural sector faces increasing scrutiny regarding its environmental impact, organic feed additives offer a viable solution. These additives are often derived from natural sources, reducing the reliance on synthetic chemicals that can harm ecosystems. Consequently, farmers are more inclined to adopt organic practices, which not only benefit the environment but also enhance the marketability of their products. This alignment with sustainability goals is likely to propel the market forward in the coming years.

Rising Demand for Organic Livestock Products

The Global Organic Feed Additives Industry experiences a notable surge in demand for organic livestock products, driven by consumer preferences for healthier and more sustainable food options. As consumers increasingly prioritize organic certifications, livestock producers are compelled to adopt organic feed additives to meet these expectations. This trend is reflected in the projected market value of 34.0 USD Billion in 2024, with expectations to reach 57.5 USD Billion by 2035. The compound annual growth rate of 4.89% from 2025 to 2035 underscores the growing importance of organic feed additives in livestock production.

Technological Advancements in Organic Feed Production

Technological advancements in organic feed production are playing a crucial role in the evolution of the Global Organic Feed Additives Industry. Innovations in processing techniques, formulation, and delivery methods are enhancing the efficacy and appeal of organic feed additives. For example, the development of encapsulation technologies allows for better nutrient delivery and stability of organic additives. Such advancements not only improve the performance of organic feeds but also cater to the growing demand for high-quality livestock products. As technology continues to evolve, it is expected to further stimulate market growth.