Rising Demand for Animal Protein

The increasing global population and the corresponding rise in demand for animal protein are driving growth in the medicated feed-additives market. As consumers seek high-quality meat, dairy, and eggs, livestock producers are compelled to enhance animal health and productivity. In the US, the meat consumption is projected to reach approximately 100 kg per capita by 2025, necessitating the use of medicated feed additives to ensure optimal growth rates and disease prevention. This trend indicates a robust market for additives that promote animal health, thereby supporting the medicated feed-additives market. Furthermore, the need for sustainable production practices is likely to further bolster the demand for these products, as they can help reduce mortality rates and improve feed efficiency.

Growing Awareness of Zoonotic Diseases

The increasing awareness of zoonotic diseases is a critical driver for the medicated feed-additives market. As public health concerns regarding diseases transmitted from animals to humans rise, there is a heightened emphasis on maintaining animal health through effective feed additives. In the US, the prevalence of zoonotic diseases has led to a greater focus on biosecurity measures within livestock operations. This trend is likely to boost the demand for medicated feed additives that help prevent disease outbreaks, thereby supporting the medicated feed-additives market. The potential for these products to mitigate health risks associated with zoonotic diseases positions them as essential components in modern animal husbandry.

Regulatory Compliance and Quality Assurance

The medicated feed-additives market is significantly influenced by regulatory compliance and quality assurance measures. In the US, stringent regulations governing the use of medicated feed additives are prompting manufacturers to invest in high-quality products that meet safety standards. The market is witnessing a shift towards additives that are not only effective but also compliant with regulatory requirements. This focus on quality assurance is likely to enhance consumer trust and drive sales in the medicated feed-additives market. As regulations evolve, companies that prioritize compliance and quality are expected to gain a competitive edge, further propelling market growth.

Increased Focus on Animal Health and Welfare

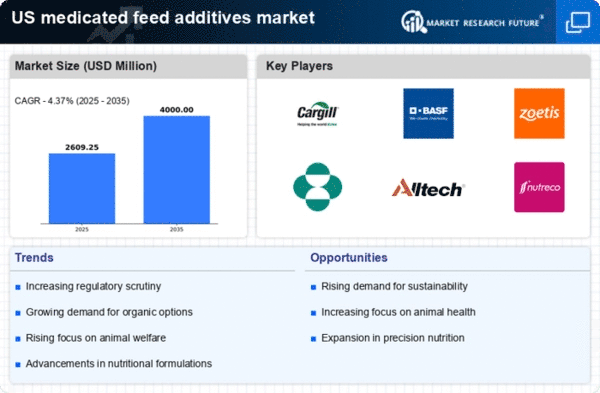

There is a growing awareness regarding animal health and welfare among consumers and producers alike, which is significantly impacting the medicated feed-additives market. The US market has seen a shift towards products that not only enhance growth but also ensure the overall well-being of livestock. This trend is reflected in the increasing sales of medicated feed additives, which are expected to grow at a CAGR of around 5% through 2025. Producers are increasingly adopting these additives to prevent diseases and improve the quality of animal products. The medicated feed-additives market is thus positioned to benefit from this heightened focus on health and welfare, as it aligns with consumer preferences for ethically produced food.

Technological Innovations in Feed Production

Technological advancements in feed production are playing a crucial role in shaping the medicated feed-additives market. Innovations such as precision nutrition and advanced formulation techniques are enabling producers to create more effective and targeted feed additives. In the US, the integration of technology in feed production is expected to enhance the efficacy of medicated additives, leading to improved animal health outcomes. The medicated feed-additives market is likely to see a surge in demand for products that utilize these technologies, as they offer better performance and cost-effectiveness. This trend suggests that ongoing research and development in feed technology will continue to drive market growth.