Market Share

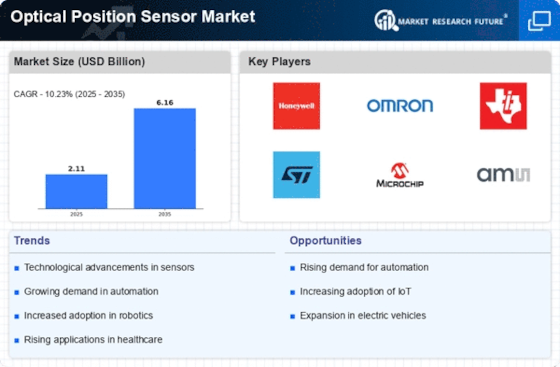

Optical position sensor Market Share Analysis

Market share positioning strategies in the Optical Position Sensor Market are crucial for companies seeking a competitive edge in this dynamic industry. One key strategy involves differentiation through technological innovation. Companies spend enormous amounts of money on research and development to unveil the innovative features generated in their optical sensors. Companies attempt to create a special competitive place and attract loyal clients through providing unique functions, high precision, and advanced performance.

Another important aspect is pricing. When cost considerations may decide on the side of a consumer, companies strategically price their products so as to gain an edge over rivals in such markets. Others choose a cost leadership strategy by aiming to produce optical position sensors at lower prices than their competitors without sacrificing the quality of products. Some of them place themselves as the premium brand where they strive to offer rich, feature-filled sensors at a high price.

The market players also use collaboration and partnerships as key strategies. Creating alliances with other firms or undertaking strategic partnerships helps businesses use complementary strengths and resources. This process enables the construction of comprehensive solutions and widens market coverage. Collaboration may take the form of sensor manufacturers teaming up with technology suppliers, integrators, or end-users in creating synergies from which overall market reputation could be strengthened.

Additionally, active marketing and branding techniques are essential. Companies spend on developing a reputable brand picture to ensure that customers trust them and are credible. Brand recognition of such a distinct value proposition from optical position sensors is created as well through clear and effective communication. Marketing strategies include showcasing certain jobs, the industries they serve or higher performance of their products over competitors.

Another important market share positioning strategy is geographical expansion. Companies deliberately aim at areas with high growth an unexploited market. Through the effective entry into these markets, firms can gain ground in terms of market share and exploit emerging opportunities. This may involve localization initiatives such as customizing products according to regional needs, cultures and tastes.

Furthermore, client-oriented methodologies are becoming popular. The personalized market position also stems from the efforts made to understand and attend to unique customer needs in various industries. This includes providing personalized solutions, excellent customer service and creating long-term partnerships.

In order to adjust the market focus on sustainability, eco-friendly positioning is emerging as a significant marketing strategy. Many firms are adopting eco-friendly practices in their production lines and promoting product recyclability.

Finally, agility and adaptability are significant strategies in a dynamic environment. Companies that can quickly respond to changing customer demands, technological advancements, and market trends position themselves for success. This adaptability may involve continuous product improvement, flexibility in production processes, and the ability to swiftly integrate emerging technologies into optical position sensor offerings.

Leave a Comment