Top Industry Leaders in the Optical position sensor Market

The Competitive Landscape of the Optical Position Sensor Market

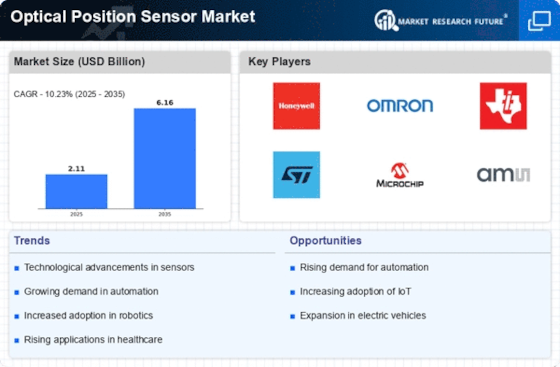

The invisible world of precise positioning is illuminated by the optical position sensor market. These sensors, utilizing light beams to measure distance, displacement, and angle, are fueling innovations across industries, from industrial automation to advanced robotics and even healthcare. Understanding the competitive landscape of this dynamic market is crucial for companies seeking to leverage its potential

Key Player:

- Sensata Technologies

- Honeywell

- Allegro MicroSystems

- SICK AG

- Bourns

- ams AG

- STMicroelectronics

- Vishay

- TE Connectivity

- Infineon Technologies

- MTS Systems

Strategies Adopted by Leaders:

- Technology Diversification: Established players like SICK and Omron are expanding beyond traditional laser triangulation sensors, offering solutions based on Time-of-Flight (ToF) technology for extended ranges and CMOS image sensors for high-resolution image-based position measurement.

- Miniaturization and Integration: Shrinking device footprints and integration of multiple functionalities are crucial for compact applications. TE Connectivity's miniature reflective sensors fit tight spaces, while ams' integrated position and acceleration sensors simplify design for wearables.

- Focus on Performance and Accuracy: High precision and reliability are paramount in demanding applications. Micro-Epsilon's laser interferometers offer nanometer-level accuracy for scientific research, while Pepperl+Fuchs' absolute encoders ensure robust position tracking in harsh industrial environments.

- Software and Data Analytics Integration: Converting raw sensor data into actionable insights is key. SICK's software platforms collect and analyze data from diverse sensors, enabling predictive maintenance and process optimization.

- Strategic Partnerships and Acquisitions: Collaborations and acquisitions accelerate market reach and expertise. STMicroelectronics' partnership with ams expands their sensor portfolio for automotive applications, while Honeywell's acquisition of Ximea strengthens its industrial vision technology offerings.

Factors for Market Share Analysis:

- Brand Reputation and Installed Base: Established players with proven track records and extensive deployments hold an advantage. SICK's reputation for high-quality sensors and Omron's vast installed base in industrial automation attract loyal customers.

- Technology Breadth and Depth: Offering a diverse range of sensors for various applications, like AMS' leadership in CMOS image sensors for mobile devices, attracts a wider client base.

- Cost-Competitiveness and Affordability: Balancing functionality with affordability is important for price-sensitive markets. Chinese manufacturers like BOE and Sunny Optronics offer cost-effective sensors for consumer electronics and automotive applications.

- Compliance and Regulatory Certifications: Meeting industry standards and safety regulations is crucial. SICK's compliance with SIL safety standards in critical applications differentiates them, while Pepperl+Fuchs' explosion-proof sensors cater to hazardous industrial environments.

- Technical Support and Application Expertise: Comprehensive support and guidance are invaluable for integrating sensors into complex systems. Micro-Epsilon's in-house calibration and application consulting services enhance customer satisfaction, while Omron's global technical support network ensures prompt assistance.

New and Emerging Companies:

- Vayyar Imaging: Pioneering wall-penetrating radar sensors for applications like security and monitoring, offering unique capabilities beyond traditional optical technologies.

- Time of Flight International: Specializing in high-precision ToF sensors for long-range distance measurement, catering to industries like autonomous vehicles and drones.

- pmdtechnologies: Focusing on 3D imaging sensors for robotics and augmented reality applications, enabling advanced object recognition and manipulation.

- Lumentum: Offering optical components and modules for LiDAR systems, powering the autonomous vehicle revolution and providing high-resolution mapping capabilities.

Latest Company Updates:

Sensata Technologies:

- September 26, 2023: Sensata launches the RLS 5100 series of miniature incremental encoders specifically designed for harsh industrial environments. These encoders feature rugged construction, high shock and vibration resistance, and extended operating temperature range, making them ideal for applications in robotics, factory automation, and heavy machinery

- June 21, 2023: Sensata announces the acquisition of Encon Solutions, a leading provider of industrial position sensors and measurement systems. This acquisition expands Sensata's portfolio of optical position sensors and strengthens its presence in the industrial automation market

Honeywell:

- October 4, 2023: Honeywell completes the acquisition of Ximea, a leading manufacturer of high-precision CMOS image sensors and cameras. This acquisition strengthens Honeywell's vision technology portfolio and expands its offerings for robotics, medical imaging, and industrial inspection applications

- August 17, 2023: Honeywell introduces the 9100C absolute encoder, offering high accuracy and reliability for demanding industrial applications. This encoder features a compact design, extended operating temperature range, and enhanced EMI immunity