Growing Geriatric Population

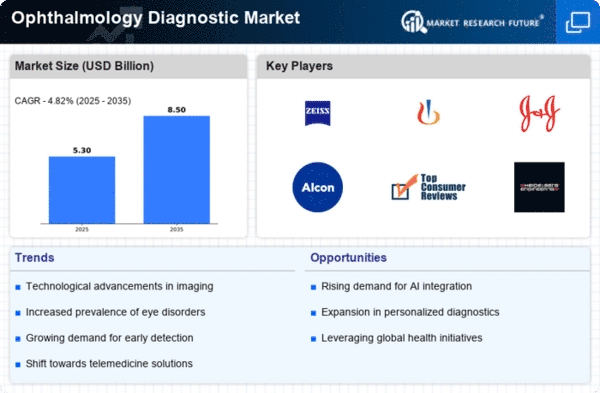

The aging population worldwide is a significant factor contributing to the expansion of the Global Ophthalmology Diagnostic Market Industry. As individuals age, they become more susceptible to various eye disorders, necessitating regular diagnostic assessments. The demographic shift towards an older population is evident in many countries, leading to an increased demand for ophthalmic diagnostics. This trend is expected to result in a market value of 8.5 USD Billion by 2035. The growing geriatric population underscores the need for healthcare systems to adapt and enhance their diagnostic capabilities to address the specific needs of older adults.

Rising Awareness and Education

The Global Ophthalmology Diagnostic Market Industry benefits from rising awareness and education regarding eye health. Public health campaigns and educational programs are increasingly informing populations about the importance of regular eye examinations and early detection of eye diseases. This heightened awareness is likely to drive demand for diagnostic services, as individuals seek proactive measures to maintain their vision. Consequently, the market is poised for growth, with an increasing number of patients seeking diagnostic evaluations. This trend indicates a shift towards preventive healthcare, which is essential for reducing the incidence of severe eye conditions.

Increased Healthcare Expenditure

Growing healthcare expenditure globally is a key driver of the Global Ophthalmology Diagnostic Market Industry. Governments and private sectors are investing more in healthcare infrastructure, particularly in diagnostic services. This trend is evident in various regions, where enhanced funding leads to improved access to ophthalmic care and advanced diagnostic technologies. As a result, the market is anticipated to grow at a compound annual growth rate of 4.83% from 2025 to 2035. Increased funding not only supports the development of new diagnostic tools but also facilitates training for healthcare professionals, thereby improving overall service delivery.

Rising Prevalence of Eye Disorders

The Global Ophthalmology Diagnostic Market Industry is experiencing growth due to the increasing prevalence of eye disorders such as cataracts, glaucoma, and diabetic retinopathy. As populations age, the incidence of these conditions rises, necessitating advanced diagnostic tools. For instance, the World Health Organization indicates that by 2024, the market is projected to reach 5.06 USD Billion, driven by the demand for early detection and management of these disorders. This trend suggests that healthcare systems worldwide are prioritizing ophthalmic diagnostics, thereby enhancing patient outcomes and reducing the burden of visual impairment.

Technological Advancements in Diagnostic Tools

Technological innovations are significantly influencing the Global Ophthalmology Diagnostic Market Industry. The introduction of advanced imaging techniques, such as optical coherence tomography and fundus photography, enhances diagnostic accuracy and efficiency. These innovations allow for earlier detection of eye diseases, which is crucial for effective treatment. As a result, the market is expected to grow, with projections indicating a value of 8.5 USD Billion by 2035. The integration of artificial intelligence in diagnostic processes further streamlines operations and improves patient care, suggesting a transformative shift in ophthalmic diagnostics.