Rising Prevalence of Eye Disorders

The increasing prevalence of eye disorders, such as diabetic retinopathy and age-related macular degeneration, is a significant driver for the Ophthalmology PACS Picture Archiving and Communication System Market. As populations age and lifestyle-related factors contribute to vision impairment, the demand for efficient diagnostic and treatment solutions is escalating. According to recent estimates, nearly 285 million people worldwide are visually impaired, highlighting the urgent need for advanced ophthalmic care. This growing patient population necessitates the adoption of sophisticated PACS solutions to manage and archive vast amounts of imaging data, thereby propelling market growth.

Growing Demand for Teleophthalmology Services

The demand for teleophthalmology services is on the rise, significantly influencing the Ophthalmology PACS Picture Archiving and Communication System Market. As healthcare providers seek to expand access to eye care, teleophthalmology offers a viable solution for remote consultations and follow-ups. This trend is particularly relevant in underserved areas where access to specialized care is limited. The ability to store and share imaging data through PACS enhances the efficiency of teleophthalmology services, making it easier for practitioners to collaborate and provide timely care. Consequently, this growing demand is expected to drive market expansion in the coming years.

Technological Advancements in Imaging Systems

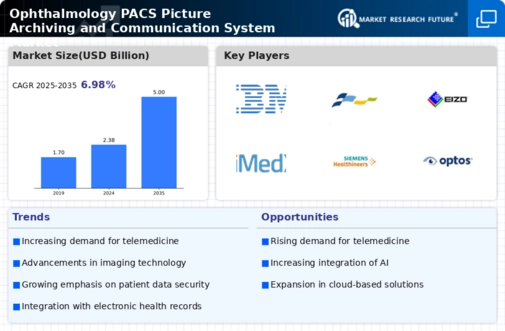

The Ophthalmology PACS Picture Archiving and Communication System Market is experiencing a surge in demand due to rapid technological advancements in imaging systems. Innovations such as high-resolution imaging and enhanced visualization techniques are improving diagnostic accuracy and treatment outcomes. The integration of advanced imaging modalities, including Optical Coherence Tomography (OCT) and fundus photography, is becoming increasingly prevalent. These advancements not only facilitate better patient management but also streamline workflows in ophthalmic practices. As a result, the market is projected to grow at a compound annual growth rate of approximately 8% over the next five years, driven by the need for more efficient and effective diagnostic tools.

Regulatory Support for Digital Health Solutions

Regulatory bodies are increasingly supporting the adoption of digital health solutions, which is positively impacting the Ophthalmology PACS Picture Archiving and Communication System Market. Initiatives aimed at promoting telemedicine and digital health records are encouraging healthcare providers to invest in advanced PACS systems. For instance, recent policies have emphasized the importance of interoperability and data sharing among healthcare systems, which aligns with the functionalities of PACS. This regulatory environment fosters innovation and investment in ophthalmic imaging technologies, potentially leading to a more integrated healthcare ecosystem.

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a crucial driver for the Ophthalmology PACS Picture Archiving and Communication System Market. Governments and private entities are allocating substantial resources to enhance healthcare facilities, particularly in developing regions. This investment often includes the implementation of advanced imaging technologies and data management systems, such as PACS. As healthcare providers upgrade their infrastructure to meet modern standards, the adoption of ophthalmology PACS solutions is likely to increase. This trend not only improves patient care but also supports the overall growth of the ophthalmic imaging market.

Leave a Comment