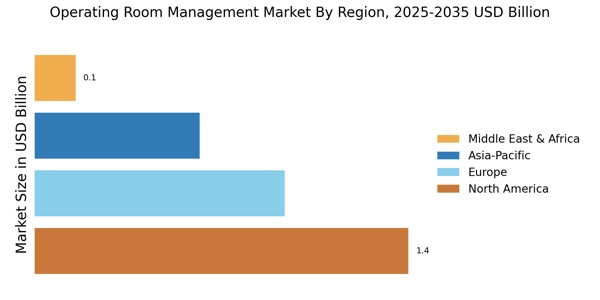

By Region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. The North America, Operating room management Market accounted for USD 1.145 billion in 2022 and is expected to exhibit a significant CAGR growth during the study period. The fast use of robotic surgery in this area is also propelling market revenue expansion of Operating room management Market. Healthcare firms' successful adoption of EHR records substantially impacts this Region's market revenue growth. Due to the rising frequency of chronic diseases, the United States market accounted for the biggest revenue share.

The major market players in this nation are launching new products and spending a lot of money to improve their market positions, causing the market to increase in revenue.

Further, the major countries studied in the market report are: The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: OPERATING ROOM MANAGEMENT MARKET SHARE BY REGION 2022 (%)

The second-largest revenue share in 2021 was attributed to the Europe Operating room management Market. Quick technical developments in operating room management systems and breakthroughs in A.I. technology are driving significant market revenue growth Operating room management Market in this area. The European Commission's proposed A.I. Act aims to safeguard A.I. security and promote the Deployment of trustworthy A.I. in E.U. economies. Due to its sophisticated healthcare system, the U.K. market accounted for the biggest revenue share. Also, increasing market participant investments will lead to the launch of innovative products, which will drive market expansion.

Further, the Germany Operating room management Market held the largest market share, and the U.K. Operating room management Market was the fastest-growing market in the European Region.

Due to a growing need for advanced medical equipment, the Asia Pacific Operating room management Market had the third-largest sales share in 2021. Furthermore, a sizable patient base with chronic illnesses is propelling revenue development in this area. Due to major market participants in Japan, the country's market contributed the highest income. For instance, the Japanese government granted regulatory clearance to Medicaroid's Hinotori, the first robotic surgical system made in Japan, on August 7, 2020. On December 4, 2020, Japanese medical institutions will have access to the H.F.

Series Instrument, a reusable active end therapy device, and the Hinotori Surgical Robot System, a surgical robot unit. Moreover, the China market of Operating room management Market held the largest market share, and the India market of Operating room management Market was the fastest-growing market in the Asia-Pacific region.