October 2023 – UNICC Co-operates with Canonical, which is known for Ubuntu and provides open-source security, support and services, to design and construct the secure private cloud environment for the UN System, ensuring enhanced security and data sovereignty for the UN’s most critical information technologies and software applications.

September 2022: As was the case with the previous version, the latest version of Red Hat’s OpenStack platform introduces new features that are tailored towards telecom operators, creating an even closer link between the platform and the company's OpenShift cloud-native platform.

June 2022: VEXXHOST Inc. has made an announcement regarding the release of Atmosphere. This is a new tool that allows for a more integrated deployment of an entire OpenStack environment. Also, the company has implemented these technologies in an open-source manner in order to take advantage of all consumers of a cloud-based infrastructure as a service SaaS platform.

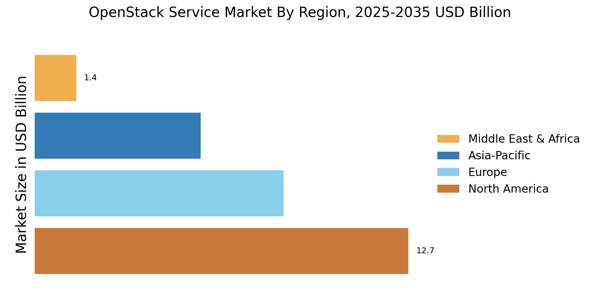

September 2023: To remove the anticipated challenges to the growth of the market, other regions will have diversified economies with major players and an inclination towards advanced technology, thus driving the growth opportunities that will exist during the forecast period.

The announcement by Red Hat, Inc. of the general release of Red Hat OpenStack Services on OpenShift on August 2024 provided a glimpse as to why this company occupies a leading position in the open-source solutions industry. This is a notable advancement which I believe would be very good for the enterprises particularly the telecommunication service providers. This release improves the merging of the conventional and the cloud-based network into a seamless network architecture.

The Red at OpenStack services on OpenShift strategy easily shifts the organizations into transformational virtualization approaches within the cloud-based environment, which makes scaling, upgrading and adding resources within the organizations easier, hence better operating efficiencies and flexibility.

In line with the vision of becoming end–to–end hybrid, multi-cloud, and AI-driven solutions provider, Rackspace Technology, in August 2024, reiterated its focus on the operationalization of the OpenStack vision when it launched Rackspace OpenStack Enterprise. The multi-tenancy cloud model is a fully managed cloud that is designed to cater to the needs of enterprise clients who have workloads that need protection, optimization and scaling. Rackspace's continued support of OpenStack allows companies to deploy cloud solutions without worrying about any infrastructure in place and thus concentrate on innovations only, all at a very affordable cost.

End users of OpenStack enterprise from Rackspace also ride on the exceptional support and expertise that Rackspace provides, which ensures that the performance and efficiency of their cloud environments are optimal.