Cost Competitiveness

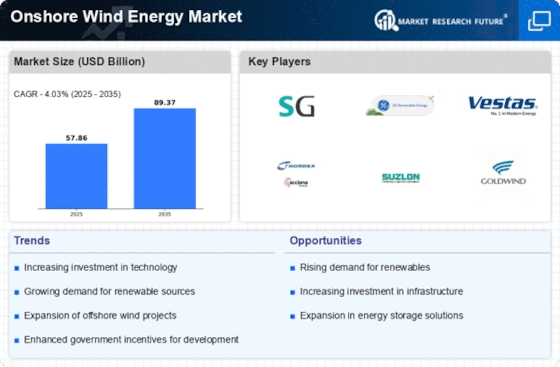

The Onshore Wind Energy Market has witnessed a remarkable decline in the cost of wind energy generation over the past decade. The levelized cost of electricity (LCOE) from onshore wind has decreased significantly, making it one of the most cost-effective sources of energy. Recent reports indicate that the LCOE for onshore wind has fallen by nearly 50% since 2010, making it competitive with fossil fuels in many regions. This cost competitiveness is likely to attract further investments and drive the expansion of onshore wind projects. As technology continues to advance, the efficiency of wind turbines improves, which may lead to even lower costs in the future. Thus, the Onshore Wind Energy Market stands to benefit from this trend, enhancing its attractiveness to investors and policymakers alike.

Increasing Energy Demand

The Onshore Wind Energy Market is experiencing a surge in energy demand, driven by population growth and industrial expansion. As economies develop, the need for sustainable and reliable energy sources becomes paramount. According to recent data, energy consumption is projected to rise by approximately 30% by 2040. This increasing demand for energy is likely to propel investments in onshore wind energy projects, as they offer a viable solution to meet the growing needs while minimizing carbon emissions. Furthermore, the shift towards electrification in various sectors, including transportation and heating, further amplifies the demand for renewable energy sources. Consequently, the Onshore Wind Energy Market is positioned to play a crucial role in addressing this escalating energy demand.

Technological Innovations

Technological advancements play a pivotal role in shaping the Onshore Wind Energy Market. Innovations in turbine design, materials, and energy storage solutions have significantly enhanced the efficiency and reliability of wind energy generation. For example, the development of larger and more efficient turbines has increased energy output while reducing the cost per megawatt. Additionally, advancements in predictive maintenance technologies enable operators to optimize performance and minimize downtime. As these technologies continue to evolve, they are likely to drive further growth in the onshore wind sector. The integration of smart grid technologies also presents opportunities for improved energy management and distribution, thereby enhancing the overall effectiveness of the Onshore Wind Energy Market.

Government Incentives and Policies

The Onshore Wind Energy Market is significantly influenced by government incentives and supportive policies aimed at promoting renewable energy. Many countries have implemented favorable regulatory frameworks, including tax credits, grants, and feed-in tariffs, to encourage the development of onshore wind projects. For instance, the introduction of renewable portfolio standards mandates a certain percentage of energy to be sourced from renewables, which has spurred investments in the sector. As of 2025, numerous nations are expected to enhance their commitments to renewable energy, further solidifying the role of onshore wind in their energy mix. These government initiatives not only facilitate project financing but also create a stable environment for the Onshore Wind Energy Market to thrive.

Public Support for Renewable Energy

Public sentiment towards renewable energy sources, particularly wind energy, is increasingly favorable, which positively impacts the Onshore Wind Energy Market. Surveys indicate that a significant majority of the population supports the transition to renewable energy, recognizing its benefits for environmental sustainability and energy independence. This growing public support often translates into political backing for renewable energy initiatives, leading to more robust policies and funding for onshore wind projects. Furthermore, community engagement in wind energy projects fosters local acceptance and can mitigate opposition. As awareness of climate change and environmental issues continues to rise, the Onshore Wind Energy Market is likely to benefit from this trend, facilitating the development of new projects and the expansion of existing ones.