Top Industry Leaders in the Onshore Wind Energy Market

*Disclaimer: List of key companies in no particular order

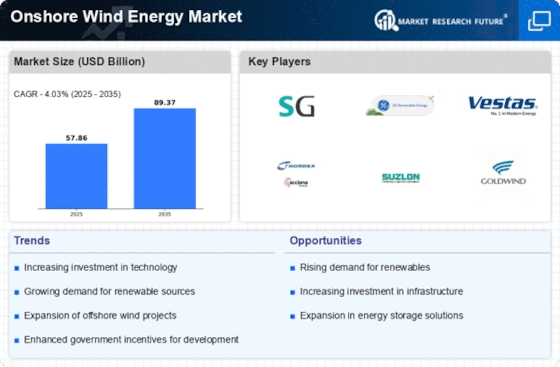

The onshore wind energy market, a pivotal force in the global transition towards renewable energy, is currently engaged in a dynamic interplay among well-established industry leaders, ambitious newcomers, and disruptive technologies. In this rapidly evolving industry, a profound understanding of the competitive landscape becomes imperative for effective navigation.

Market Share Analysis: Unveiling the Powerhouses

Prominent players dictating the onshore wind landscape include:

- Siemens AG (Germany)

- Envision Energy (China)

- General Electric Wind Energy (U.S.)

- Suzlon (India)

- Vestas Wind System A/S (Denmark)

- Enercon GmbH (Germany)

- Mitsubishi Power Systems (Japan)

- Nordex S.E. (Germany)

- Repower (Switzerland)

- Gazelle Wind Turbines (U.K.)

- Clipper Wind Power (UK), and others.

Several factors contribute to market share dynamics in the onshore wind sector:

• Installed Capacity: Vestas Wind Systems, Siemens Gamesa Renewable Energy, and Goldwind International lead the pack, commanding significant shares based on cumulative installed capacity.

• Regional Presence: Powerhouses like GE Renewable Energy, dominating the Americas, and Enercon, a European stronghold, fiercely compete within their respective territories.

• Technology & Innovation: Companies such as Mingyang Smart Energy and Nordex SE are making strides with next-generation turbines boasting higher efficiency and lower costs.

Key Player Strategies: Adapting for Thriving Success

Established players are implementing diverse strategies to maintain their competitive edge:

• Geographic Expansion: Vestas and Siemens Gamesa are venturing into emerging markets like China and India, while GE Renewable Energy focuses on solidifying its foothold in established markets.

• Product Diversification: Offering a broader range of turbine sizes and technologies caters to varied customer needs and wind resources. Vestas emphasizes its EnVentus platform, while Siemens Gamesa focuses on offshore expertise.

• Vertical Integration: Companies like Goldwind are integrating upstream manufacturing to secure supply chains and optimize costs.

• Partnerships & Acquisitions: Strategic alliances and acquisitions accelerate technology transfer and market access. For instance, GE's stake in Continuum Green Energy enhances its presence in India.

New & Emerging Trends: Transforming the Landscape

Exciting trends are reshaping the onshore wind market:

• Digitalization & Automation: From smart turbines to remote monitoring, data-driven solutions are optimizing wind farm operations and maintenance.

• Focus on Cost Reduction: The paramount focus on Levelized Cost of Energy (LCOE) reduction drives technological advancements like larger blades and higher capacity factors.

• Growing Focus on Environmental & Social Impact: Responsible sourcing, community engagement, and biodiversity conservation are becoming crucial differentiators.

The Competitive Scenario: An Intricate Tapestry

The competitive landscape remains intricate:

• Intensified Price Competition: With LCOE reduction becoming critical, price wars are common, especially in mature markets.

• The Looming Shadow of Offshore Wind: While onshore wind maintains dominance, the rapid growth of offshore wind creates long-term strategic considerations for industry players.

• Emerging Economies as Battlegrounds: China and India, with their immense potential, attract established players and local champions, intensifying competition.

Concluding Thoughts: A Dynamic Future Awaits

The onshore wind energy market is a dynamic sphere propelled by technological advancements, evolving regulations, and shifting market dynamics. Staying abreast of these trends and understanding the strategies of key players is vital for navigating this competitive landscape. Whether established giants, agile newcomers, or technology disruptors, those who adapt and innovate will be the ones shaping the future of this critical industry.

Industry Developments and Latest Updates:

Siemens Gamesa Renewable Energy (SGRE):

- Dec 15, 2023: Siemens Gamesa and Siemens Energy unveil plans to form a new wind turbine business, combining SGRE's onshore and offshore wind businesses with Siemens Energy's service operations. (Source: Siemens Gamesa press release)

Envision Energy:

- Nov 10, 2023: Envision unveils the EN156, a new 6 MW onshore wind turbine designed for complex terrain and low wind speeds. (Source: Envision Energy website)

General Electric Renewable Energy (GE Renewable Energy):

- Dec 12, 2023: GE Renewable Energy and EDPR Renewables North America announce a joint venture to develop and build a 1.5 GW onshore wind farm in Texas. (Source: GE Renewable Energy press release)

Vestas Wind Systems A/S:

- Dec 13, 2023: Vestas secures a 168 MW order for a wind farm project in Sweden. (Source: Vestas website)