Top Industry Leaders in the Online Classified Market

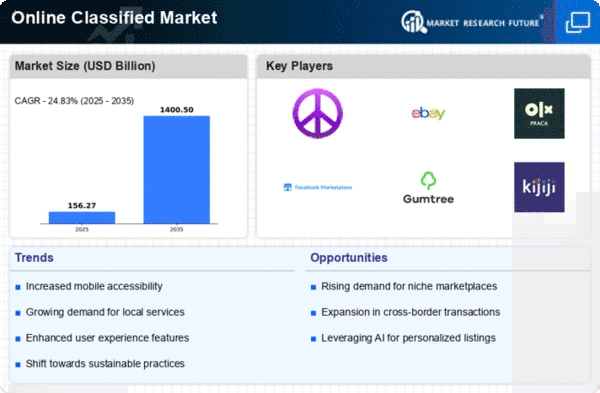

Introduction: The online classifieds market has become a dominant force in the e-commerce landscape, offering convenient and accessible platforms for buying and selling goods and services. This dynamic market is characterized by fierce competition, with established players vying for market share alongside new and emerging companies. Understanding the competitive landscape is crucial for businesses operating in this space to navigate this competitive environment, identify opportunities, and develop effective strategies.

Key Players:

- Masig (Singapore)

- Singapore Press Holdings Ltd. Co. (Singapore)

- Syoknya (Malaysia)

- Jual (Malaysia)

- Craigslist (US)

- my (US), among others

These platforms attract millions of users and boast substantial market share. They utilize various strategies to maintain their dominance, including:

- Network effects: Building a large user base attracts both buyers and sellers, further solidifying their position.

- Brand recognition: Extensive marketing campaigns and established brand names create significant trust and familiarity among users.

- Diversification: Expanding into new categories and services provides additional value for users and strengthens their overall market presence.

- Tech innovation: Continuous development of innovative features and functionalities enhances user experience and attracts new users.

Factors for Market Share Analysis: Several factors are crucial for analyzing market share in the online classifieds market:

- Number of listings: This reflects the platform's attractiveness to sellers and its potential for buyers to find desired items.

- Traffic volume: Higher website traffic indicates a larger user base and potential for engagement with listings.

- Revenue generation: Analyzing revenue generated through advertising, premium listings, and other monetization strategies provides insight into a platform's financial health and ability to invest in further growth.

- User engagement: Metrics such as time spent on site, number of page views, and click-through rates measure user engagement and platform effectiveness.

- Geographic reach: The platform's availability in different regions and its success in specific markets is important for understanding its global footprint.

New and Emerging Companies: Several new and emerging companies are challenging the established players in the online classifieds market:

- Vertical-specific platforms: These platforms focus on specific categories like fashion, electronics, or furniture, providing a more curated and efficient experience for users within those niches.

- Mobile-first platforms: Recognizing the growing mobile user base, these platforms prioritize mobile functionality and offer user-friendly apps for convenient listing and browsing.

- Hyperlocal platforms: These platforms focus on specific geographical areas, catering to local communities and providing a more personalized experience for users within that area.

- Blockchain-based platforms: These platforms leverage blockchain technology for increased transparency, security, and trust in online transactions.

Current Company Investment Trends: Companies in the online classifieds market are currently investing in several key areas:

- Artificial intelligence: AI-powered features are being implemented to improve search functionality, personalize recommendations, and optimize ad targeting.

- Data analytics: Utilizing data analytics to understand user behavior and preferences allows platforms to tailor their offerings and improve user experience.

- Mobile app development: Investments in mobile app development are crucial to meet the growing demand for convenient access and on-the-go browsing.

- International expansion: Established players are focusing on expanding into new markets to capture a wider audience and increase their reach.

- Partnerships and acquisitions: Strategic partnerships and acquisitions allow companies to acquire new technologies, expand their product offerings, and enter new markets.

August 2023 -in 2023, Atos has publicly announced the brand of its €5 billion spin-off subsidiary months before the official launch of Eviden. Atos, a major provider of IT services, announced in June of last year that it would divide into two about equal-sized businesses, Atos and Eviden. The board of the Paris-listed company claims that splitting the €11 billion business will "create the highest value for shareholders and other stakeholders." The business was created in 1997 as a result of a French-Dutch merger and now has operations in over 70 nations.

In order to strengthen the assistance, it offers to its indirect sales channel, Kore.ai, the top enterprise conversational AI (CAI) platform and solutions provider in the world, has announced a new partner programme for 2023.

The new Programme introduces a new tiering system for channel partners and solution providers, allocates sizeable resources to each partner, and covers go-to-market (GTM), enablement, and marketing assistance.

The launch of EOS PowerPay, a new campaign from EOSGlobe, a top supplier of business process management services, was announced today for 2023. The campaign emphasises seasonal spikes and short-term services that clients can access with three unique offerings: FlexiBPM, DigitalBPM+, and a range of time-bound promotions and programmes. It seeks to assist businesses in achieving exceptional growth and customer engagement across a variety of industries.