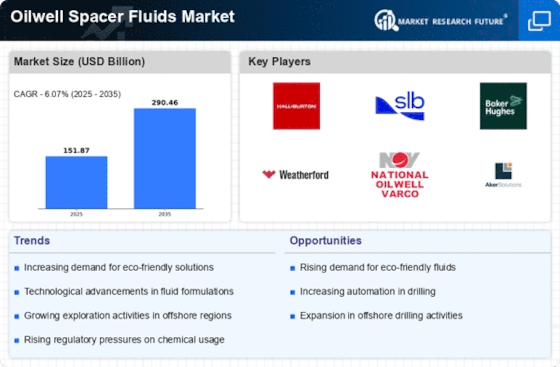

Top Industry Leaders in the Oilwell spacer fluid Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Oilwell spacer fluids industry are:

Baker Hughes Company, Chevron Phillips Chemical Company, LLC, Croda International plc, Halliburton Co., Schlumberger Ltd, M&D Industries, Atlantic Richfield Company, Elkem, BASF SE, and Archi Exim Private Limited.

Bridging the Gap by Exploring the Competitive Landscape of the Oilwell spacer fluids Top Players

The oilwell spacer fluids market, though a niche segment within the oil & gas industry, pulsates with immense competitive energy. These critical fluids, separating incompatible fluids during well completion and stimulation, demand a diverse range of offerings to cater to specific wellbore conditions and operational needs. Understanding the key players, their strategies, and emerging trends is crucial for navigating this dynamic landscape.

Key Players and their Playbooks:

- Global Giants: Halliburton, Schlumberger, and Baker Hughes lead the pack with extensive product portfolios, robust R&D capabilities, and established distribution networks. They prioritize technical advancements, offering customized spacer fluids and automation solutions. Halliburton's Smart Spacer™ and Schlumberger's EcoStim™ series exemplify their focus on performance and environmental sustainability.

- Regional Champions: National Oilwell Varco (NOV) and Superior Energy Services cater to specific regional demands. NOV leverages its strong presence in North America, while Superior Energy Services thrives in the Middle East with its cost-effective spacer blends. These players focus on building strong customer relationships and tailoring offerings to local regulations and wellbore complexities.

- Niche Specialists: Companies like M&D Industries and Croda International excel in specific spacer fluid types. M&D Industries specializes in bio-based and environmentally friendly spacers, while Croda International focuses on high-performance demulsifiers and rheology modifiers. These niche players leverage their expertise to carve out profitable segments within the larger market.

Factors Shaping Market Share Dynamics:

- Technological Superiority: The ability to develop innovative spacer fluids that address evolving wellbore challenges and environmental concerns holds significant sway. Players like Halliburton, with their focus on automation and data-driven solutions, gain an edge.

- Operational Efficiency: Streamlined manufacturing, logistics, and deployment processes translate to cost savings and quicker turnaround times. Superior Energy Services, with its efficient regional operations, demonstrates this advantage.

- Sustainability Credentials: Environmentally friendly spacer fluids are gaining traction due to stricter regulations and growing operator focus on ESG goals. M&D Industries' bio-based spacers cater to this rising demand.

- Customer Relationships: Building strong relationships with oil & gas operators through technical support, customization, and training fosters loyalty and repeat business. NOV's customer-centric approach exemplifies this strategy.

New and Emerging Trends:

- Bio-based and biodegradable spacers: Driven by environmental concerns and regulations, the demand for eco-friendly alternatives to traditional oil-based fluids is surging. M&D Industries and Croda International are at the forefront of this trend.

- Digitalization and Automation: Integrating sensors, data analytics, and automated pumping systems optimizes spacer deployment and wellbore performance. Halliburton's Smart Spacer™ showcases the potential of this trend.

- Customization and Blending: Operators increasingly seek bespoke spacer blends tailored to their specific wellbore needs. Superior Energy Services' success in the Middle East highlights the effectiveness of this approach.

Overall Competitive Scenario:

The oilwell spacer fluids market is characterized by intense competition, with global giants, regional champions, and niche specialists vying for market share. Technological innovation, operational efficiency, sustainability, and strong customer relationships are key differentiators. As environmental regulations tighten and digitalization takes hold, bio-based fluids, automation solutions, and customized blends are expected to be the next wave of growth drivers. Understanding these trends and the strategies of key players will be crucial for success in this ever-evolving market.

Latest Company Updates:

Baker Hughes:

- October 2023: Launched the NovaClear™ HS wellbore cleanup fluids, engineered for improved performance in high-temperature and high-salinity environments. (Source: Baker Hughes press release)

Chevron Phillips Chemical Company, LLC:

- December 2023: Announced the expansion of its production capacity for Oronite™ performance additives, used in various oilfield applications, including spacer fluids. (Source: Chevron Phillips Chemical Company press release)

Croda International plc:

- June 2023: Acquired the industrial fluids business of Solvay, which strengthens Croda's position in the oilfield chemicals market, including spacer fluids. (Source: Croda International plc press release)

Halliburton Co.:

- January 2024: Launched the OptiWell™ Pro series of spacer fluids, designed to optimize well cleaning and improve stimulation efficiency. (Source: Halliburton press release)

Schlumberger Ltd:

- December 2023: Unveiled the EcoWell™ suite of sustainable well completion and stimulation fluids, including bio-based spacer fluids. (Source: Schlumberger press release)