Expansion of Oil and Gas Infrastructure

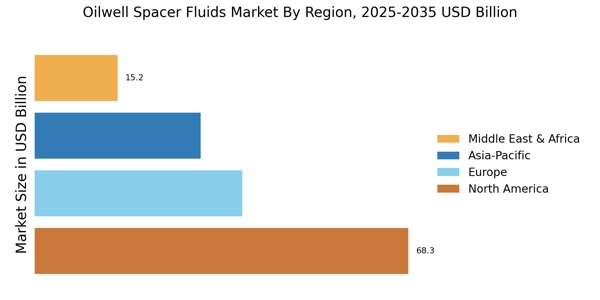

The expansion of oil and gas infrastructure is a critical driver for the Oilwell Spacer Fluid Market. As new pipelines, refineries, and processing facilities are developed, the need for effective drilling and completion fluids becomes paramount. This infrastructure growth is particularly pronounced in emerging markets, where energy demand is escalating. The construction of new drilling sites necessitates the use of spacer fluids to ensure proper cementing and well integrity. Furthermore, the ongoing maintenance and upgrading of existing facilities also contribute to the demand for these fluids. As investments in infrastructure continue to rise, the market for oilwell spacer fluids is expected to experience substantial growth.

Increasing Demand for Oil and Gas Exploration

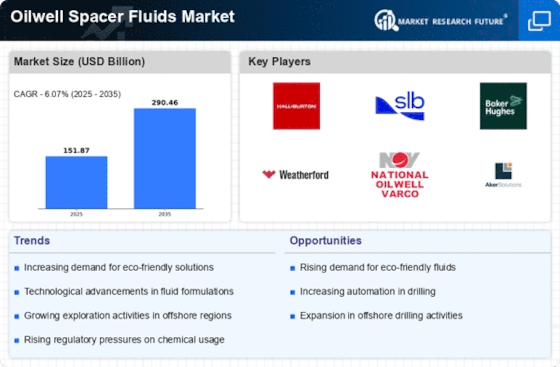

The Oilwell Spacer Fluid Market is experiencing a surge in demand due to the increasing exploration and production activities in the oil and gas sector. As countries seek to enhance their energy security, investments in drilling operations are on the rise. This trend is particularly evident in regions with untapped reserves, where companies are deploying advanced drilling techniques. The demand for spacer fluids, which serve to separate drilling mud from cement, is expected to grow as operators aim to improve well integrity and reduce operational risks. According to recent estimates, the oil and gas exploration sector is projected to grow at a compound annual growth rate of approximately 5% over the next few years, further driving the need for effective spacer fluids.

Rising Investment in Renewable Energy Sources

While the Oilwell Spacer Fluid Market is primarily associated with traditional oil and gas operations, the rising investment in renewable energy sources is indirectly influencing the market. As energy companies diversify their portfolios to include renewable projects, there is a growing need for efficient drilling solutions in both conventional and unconventional resources. This diversification may lead to increased demand for spacer fluids that can be utilized in various applications, including geothermal energy extraction. The integration of renewable energy initiatives with traditional oil and gas operations could create new opportunities for spacer fluid manufacturers, potentially expanding their market reach and product offerings.

Technological Innovations in Drilling Techniques

Technological advancements in drilling techniques are significantly influencing the Oilwell Spacer Fluid Market. Innovations such as horizontal drilling and hydraulic fracturing have transformed the landscape of oil and gas extraction. These methods require specialized spacer fluids that can withstand high pressures and temperatures, ensuring optimal performance during drilling operations. The introduction of smart fluids, which can adapt their properties based on environmental conditions, is also gaining traction. As operators increasingly adopt these advanced techniques, the demand for high-quality spacer fluids is likely to rise. The market for these innovative solutions is expected to expand, reflecting the industry's shift towards more efficient and effective drilling practices.

Regulatory Compliance and Environmental Standards

The Oilwell Spacer Fluid Market is being shaped by stringent regulatory compliance and environmental standards. Governments and regulatory bodies are imposing stricter guidelines on drilling operations to minimize environmental impact. This has led to an increased focus on the formulation of spacer fluids that are not only effective but also environmentally friendly. Companies are investing in research and development to create biodegradable and non-toxic spacer fluids that meet these regulations. As a result, the market is witnessing a shift towards sustainable solutions, which could potentially enhance the reputation of operators and reduce liabilities associated with environmental breaches. The emphasis on compliance is likely to drive innovation and growth in the spacer fluids segment.