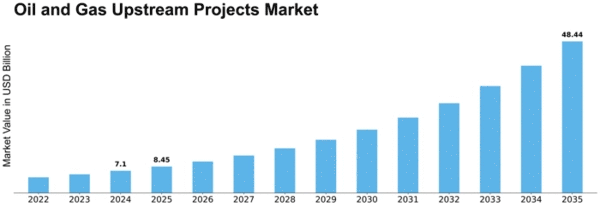

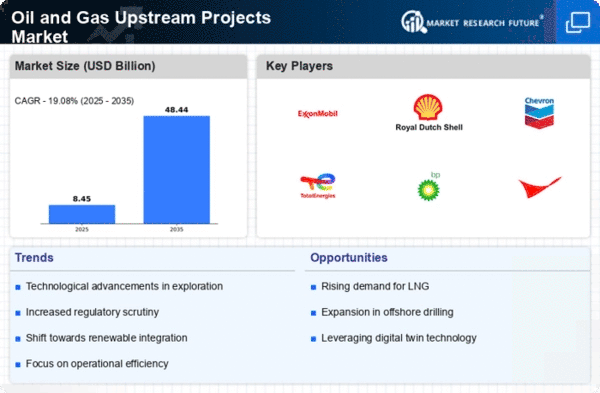

Oil Gas Upstream Projects Size

Oil Gas Upstream Projects Market Growth Projections and Opportunities

It is quite imperative to note that the oil and gas upstream projects market faces a number of factors which altogether form its dynamics in the energy sector. A major factor behind this is the world’s demand for hydrocarbons, especially oil and natural gas fuelled by increased industrialization, economic growth, and energy consumption globally. The market dynamics largely depend on the exploitation, production of these resources that ensures meeting growing energetic needs at several economies. A number of geopolitical factors contribute to the market specifics and dynamics that govern oil and gas upstream projects. The chances and conditions associated with exploration, production are affected by Geopolitical events such as geospatial politics which includes regulation rendered to the oil-producing nations. The orientation is influenced by geopolitical strains, trade deals and political stability of areas rich in hydrocarbon deposits hence the general investment climate for upstream projects. Technological innovations and developments in exploration and production methods greatly contribute to the market dynamics. New developments in seismic images, drilling technologies and reservoir management form an integral part of the changing canvas for upstream projects. It is this promise from the constant drive to increase recovery rates, reduce exploration risks and make operations efficient which guarantees that upstream ventures remain economically viable. The environment and regulatory factors are key driving forces governing the market dynamics of oil and gas upstream projects. The dynamics are also influenced by the requirements for compliance with environmental standards, safety regulations, and permitting procedural steps. Although preferences of downstream businesses play an important role in making decisions, growing attention to sustainable practices, emissions reduction, and environmental protection factors influence companies involved up the chain. Crude oil price movements play a major role in determining how the dynamics of market develop for upstream projects on oils and gas features. Their dynamics are shaped by world oil supply and demand, geopolitical factors as well as economic circumstances. One of the oil price sensitivity is upstream project investments, which may alter exploration budgets and development cost feasibility affecting profitability. The energy transition also plays a substantial role in dynamically evolving market demands, with the focus on renewable sources. The relationships are determined by the deliberate choice on behalf of oil and gas firms to diversify their portfolios, invest in renewable projects as well as reorganize according to evolving consumer preferences for innovative alternatives energy. With a new landscape of hope for energy that drives towards sustainability, investing in upstream projects becomes increasingly burdensome.

Leave a Comment