Top Industry Leaders in the Oil Gas Upstream Projects Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Oil and Gas Upstream Projects industry are:

Archer Ltd.

ATB Holding Spa

Atlas Copco AB

AXON Pressure Products Inc.

Dril Quip Inc.

Evolution Oil Tools Inc.

Flowserve Corp.

Forum Energy Technologies Inc.

General Electric Co.

Halliburton Co.

NOV Inc.

Schlumberger Ltd.

Seadrill Ltd.

Siemens AG

SPX FLOW Inc.

Sumitomo Corp.

Weatherford International Plc

Geometrics Inc.

Helmerich and Payne Inc.

Bridging the Gap by Exploring Top Leaders Competitive Landscape of the Oil and Gas Upstream Projects Market

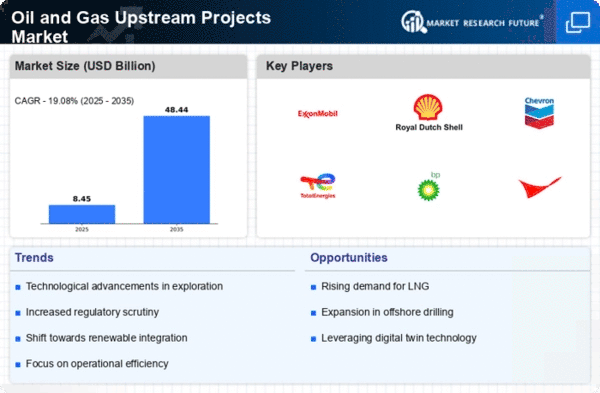

The oil and gas upstream projects market, encompassing exploration, development, and production activities, is a complex and dynamic arena. Navigating this competitive landscape necessitates a keen understanding of key player strategies, market share determinants, and emerging trends influencing the industry.

Dominant Strategies and Market Leaders:

- Integrated Giants: Supermajors like ExxonMobil, Shell, Chevron, and BP hold significant market share through vertically integrated operations, allowing them to optimize the entire value chain and manage risks effectively. Their financial muscle enables them to tackle large-scale projects and leverage economies of scale.

- National Oil Companies (NOCs): Entities like Saudi Aramco, Gazprom, and CNPC wield immense influence, often controlling vast reserves and enjoying government backing. They actively participate in joint ventures and acquisitions to expand their global footprint and secure access to new resources.

- Independent Explorers and Producers (E&Ps): These agile players excel at niche fields, focusing on unconventional resources or high-risk, high-reward projects. They adopt flexible cost structures, embrace technological advancements, and form strategic partnerships to compete against larger rivals.

Market Share Analysis: A Multifaceted Equation:

- Reserve Base and Production Capacity: Access to sizable reserves and efficient production capabilities underpin market leadership. Companies with proven reserves and established infrastructure hold a distinct advantage.

- Geographical Diversification: Operating across diverse geographical regions mitigates risks associated with price volatility and geopolitical instability. A balanced portfolio across mature and emerging basins provides stability and growth opportunities.

- Technological Prowess: Embracing cutting-edge technologies like enhanced oil recovery (EOR) techniques, automation, and artificial intelligence (AI) optimizes exploration efficiency, boosts production, and lowers operational costs, creating a competitive edge.

- Cost Efficiency and Project Management: Streamlining operations, optimizing supply chains, and managing project risks effectively contribute significantly to profitability and market share gains.

Navigating the Evolving Tides: New and Emerging Trends:

- Sustainability Focus: The pressure to decarbonize is shaping the industry. Investments in renewable energy sources and carbon capture, utilization, and storage (CCUS) technologies are gaining traction, creating new market opportunities for forward-thinking companies.

- Rise of Digitalization: Data-driven approaches are transforming upstream operations. Advanced analytics, digital twins, and real-time monitoring are optimizing decision-making, improving reservoir management, and enhancing safety.

- Unconventional Resources: The focus is shifting towards unconventional resources like shale oil and gas, requiring specialized expertise and technology. Companies with established capabilities in these areas are well-positioned to capitalize on this growth segment.

- Geopolitical Shifts: The international energy landscape is constantly evolving, with trade wars, sanctions, and resource nationalism impacting project viability and market access. Flexibility and adaptability are crucial for navigating these uncertainties.

The Competitive Horizon: A Balancing Act:

The oil and gas upstream projects market remains fiercely competitive, demanding a delicate balance between traditional strengths and adapting to new realities. While integrated giants and NOCs retain their dominance, independent E&Ps are carving out niches through agility and innovation. The race for technological supremacy is intensifying, with digitalization and sustainability playing pivotal roles in shaping the future landscape. In this dynamic environment, success hinges on the ability to navigate risks, seize opportunities, and adapt to a constantly evolving energy landscape.

Latest Company Updates:

Archer Ltd.

- Oct 27, 2023: Secured contract with Chevron for well abandonment services in the Gulf of Mexico (Source: Archer Ltd. press release).

Atlas Copco AB

- Nov 15, 2023: Launched new high-pressure compressor specifically designed for offshore oil and gas applications (Source: Atlas Copco press release).

AXON Pressure Products Inc.

- Oct 03, 2023: Received order for 100 high-pressure valves from Shell for a liquefied natural gas (LNG) project in Australia (Source: AXON Pressure Products press release).

Dril Quip Inc.

- Sep 28, 2023: Signed agreement with BP for subsea equipment supply on a major development project in the Gulf of Mexico (Source: Dril Quip Inc. press release).