Market Analysis

In-depth Analysis of Oil Gas Upstream Projects Market Industry Landscape

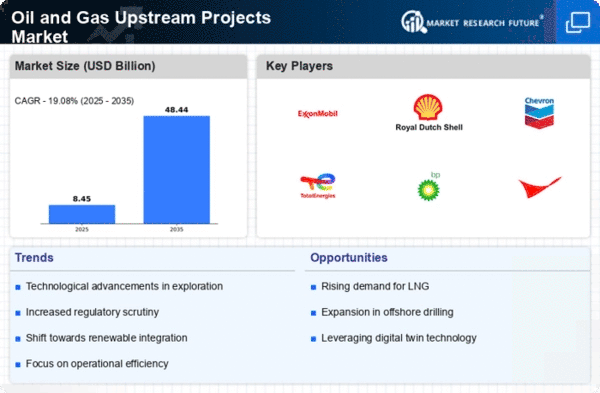

The oil and gas upstream projects market is set to reach a significant value by 2032, growing at a 4.00% CAGR between years 2023-2032. The Oil and Gas Upstream Projects Market is in a very complicated environment of change, which has been driven by different factors that define the performance itself. One of the major driving factors is global energy demand that directly hits into upstream sector. The demand for oil and gas increases as the economies grow, pushing investments from upstream projects. On the other hand, market dynamics are also very much impacted by changes in oil prices that may lead based on geopolitical trends or discrepancies between supply and demand levels as well as adjustments of production out from major producing countries. The price mechanism is quite critical for developing upstream investments as well as the overall market that governs these projects. The field of technological advancements plays a considerable role in determining the market dynamics of Oil and Gas Upstream Projects Market. New technologies in exploration, drilling and reservoir management improve production efficiency as well as saving costings of upstream operations. The implementation of state-of-the art technologies including artificial intelligence, data analytics and digitalization continue to enhance the optimization level in production processes as well that minimize operational risks. This is because these technological advancements not only affect the viability and profitability of upstream projects but also rigidity level across the industry. Regulatory environment and geopolitical factors have significant impact on the market dynamics of Oil and Gas Upstream Projects Market. The regulatory setting dictates project approvals, normally permitting processes, and compliance demands the features of overall feasibility and duration for upstream projects. Non-political factors such as geopolitical tensions, trade agreements and international relations can also play a role in determining investment decisions These sources of uncertainty transmit into market volatility and define the risk platform for upstream project. This market is augmented by environmental and sustainability issues which are impacting the dynamics of this industry. With the increasing global importance of environmental protection along with Climate Change Mitigation, there is a push therefore for reducing carbon footprint’s oil and gas activities. Strategic market positioning is achieved in upstream projects that embrace environmentally-friendly initiatives, carbon capture technologies and environmental standards requirements. There are more investors and stakeholders who now consider the environmental implications of upstream projects dictating how to move as a sort. The global shift towards renewables and the drive for decarbonization also have an impact on market dynamics. The emergence of renewable energy technologies as well as the climate change problem have been accorded a shift in investments and approaches to ensuring alternative solutions.

Leave a Comment