Rising Demand for Renewable Energy

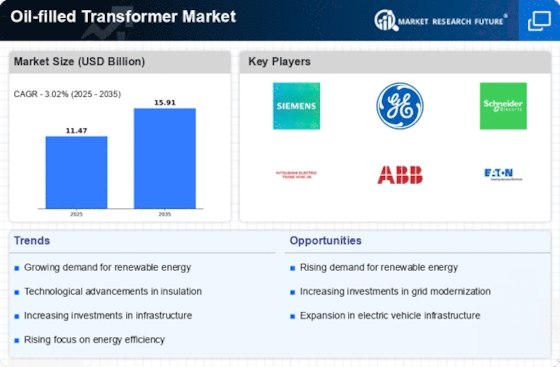

The increasing emphasis on renewable energy sources is driving the Oil-filled Transformer Market. As countries strive to meet energy transition goals, the integration of renewable energy into existing grids necessitates the use of efficient transformers. Oil-filled transformers are particularly suited for this purpose due to their ability to handle high loads and provide reliable performance. According to recent data, the demand for oil-filled transformers is projected to grow by approximately 6% annually as utilities upgrade their infrastructure to accommodate renewable energy sources. This trend indicates a robust market potential for oil-filled transformers, as they play a crucial role in enhancing grid stability and efficiency.

Growing Urbanization and Electrification

The trend of urbanization and the associated increase in electrification are pivotal drivers for the Oil-filled Transformer Market. As urban areas expand, the demand for reliable electricity supply intensifies, necessitating the deployment of efficient transformers. Oil-filled transformers are favored for their capacity to manage high power loads, making them ideal for urban settings. Data indicates that urban populations are projected to reach 68% by 2050, leading to a surge in electricity demand. This urban growth is likely to stimulate investments in oil-filled transformers, as utilities seek to enhance their distribution networks to meet the rising energy needs of urban dwellers.

Infrastructure Modernization Initiatives

Infrastructure modernization initiatives are significantly influencing the Oil-filled Transformer Market. Governments and private sectors are investing heavily in upgrading aging electrical infrastructure to improve reliability and efficiency. This modernization often involves replacing outdated transformers with advanced oil-filled models that offer better performance and longevity. Recent reports suggest that the global investment in electrical infrastructure is expected to reach USD 1 trillion by 2026, creating substantial opportunities for oil-filled transformer manufacturers. The need for enhanced power distribution systems and the replacement of obsolete equipment are likely to propel the demand for oil-filled transformers in the coming years.

Regulatory Support for Energy Efficiency

Regulatory support for energy efficiency is a crucial factor influencing the Oil-filled Transformer Market. Governments worldwide are implementing stringent regulations aimed at reducing energy consumption and promoting the use of efficient electrical equipment. These regulations often mandate the use of high-efficiency transformers, including oil-filled models, in new installations and upgrades. As a result, manufacturers are increasingly focusing on developing products that comply with these regulations. Recent statistics indicate that compliance with energy efficiency standards could enhance the market for oil-filled transformers by approximately 20% over the next five years, as utilities and industries seek to align with regulatory requirements.

Technological Innovations in Transformer Design

Technological innovations in transformer design are reshaping the Oil-filled Transformer Market. Advances in materials and engineering have led to the development of more efficient and durable oil-filled transformers. These innovations not only improve performance but also reduce maintenance costs, making them more attractive to utilities. For instance, the introduction of eco-friendly insulating oils and enhanced cooling systems has increased the operational efficiency of these transformers. Market analysis suggests that the adoption of such advanced technologies could lead to a 15% reduction in operational costs for utilities, thereby driving the demand for modern oil-filled transformers.