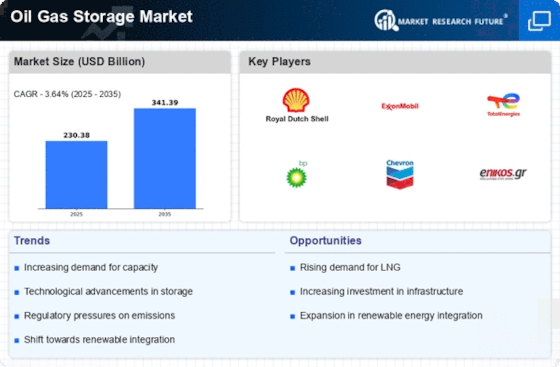

Increasing Energy Demand

The Oil Gas Storage Market is experiencing a surge in demand for energy, driven by population growth and industrialization. As economies expand, the need for reliable energy sources intensifies, leading to increased storage capacity requirements. According to recent data, energy consumption is projected to rise by approximately 30% by 2040, necessitating enhanced storage solutions. This trend compels companies to invest in advanced storage technologies to ensure a stable supply of oil and gas. Furthermore, the volatility of energy prices underscores the importance of strategic storage, allowing companies to manage supply effectively. Thus, the growing energy demand is a pivotal driver for the Oil Gas Storage Market, prompting innovations and expansions in storage facilities.

Technological Innovations

Technological advancements are revolutionizing the Oil Gas Storage Market, enhancing efficiency and safety in storage operations. Innovations such as automated monitoring systems and advanced materials for tank construction are becoming increasingly prevalent. These technologies not only improve operational efficiency but also reduce environmental risks associated with leaks and spills. For instance, the implementation of smart sensors allows for real-time monitoring of storage conditions, ensuring optimal performance. Moreover, the market is witnessing a shift towards modular storage solutions, which offer flexibility and scalability. As companies adopt these cutting-edge technologies, the Oil Gas Storage Market is likely to experience significant growth, driven by the need for safer and more efficient storage solutions.

Strategic Geopolitical Factors

Geopolitical dynamics play a crucial role in shaping the Oil Gas Storage Market. Tensions in oil-producing regions often lead to supply disruptions, prompting countries to bolster their strategic reserves. For instance, nations may increase their storage capacities to mitigate risks associated with geopolitical instability. Recent data indicates that countries are enhancing their strategic petroleum reserves, with some aiming to hold up to 90 days of net imports. This proactive approach to energy security drives investments in storage infrastructure, as nations seek to safeguard against potential supply shocks. Consequently, geopolitical factors significantly influence the Oil Gas Storage Market, as countries prioritize energy independence and security.

Shift Towards Renewable Energy Integration

The transition towards renewable energy sources is reshaping the Oil Gas Storage Market. As countries commit to reducing carbon emissions, there is a growing need for storage solutions that can accommodate both traditional fossil fuels and renewable energy. This shift necessitates the development of hybrid storage systems capable of integrating various energy sources. For instance, the rise of biofuels and hydrogen as alternative energy carriers requires innovative storage solutions that can handle diverse fuel types. Consequently, companies in the Oil Gas Storage Market are exploring new technologies and strategies to adapt to this evolving landscape. This integration of renewable energy into existing storage frameworks presents both challenges and opportunities for growth in the market.

Regulatory Compliance and Environmental Standards

The Oil Gas Storage Market is significantly influenced by stringent regulatory frameworks and environmental standards. Governments worldwide are implementing regulations aimed at minimizing environmental impacts associated with oil and gas storage. Compliance with these regulations often necessitates investments in modern storage facilities that meet safety and environmental criteria. For example, regulations may require secondary containment systems to prevent leaks, thereby increasing operational costs for companies. However, adherence to these standards can also enhance a company's reputation and operational efficiency. As regulatory pressures continue to mount, the Oil Gas Storage Market is likely to see a shift towards more sustainable practices, driving innovation and investment in compliant storage solutions.