Geopolitical Factors

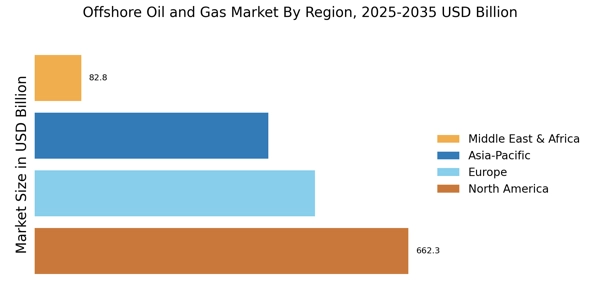

Geopolitical factors are increasingly influencing the Offshore Oil and Gas Market Industry. Political stability in oil-rich regions is crucial for ensuring uninterrupted supply chains and attracting foreign investments. Recent tensions in key oil-producing areas have led to fluctuations in oil prices, impacting the overall market dynamics. For instance, conflicts in the Middle East have historically resulted in price volatility, prompting companies to diversify their portfolios and explore offshore opportunities in more stable regions. Additionally, government policies and international relations play a pivotal role in shaping the regulatory landscape for offshore operations. As nations seek energy independence, the Offshore Oil and Gas Market Industry may experience shifts in investment patterns and operational strategies.

Rising Energy Demand

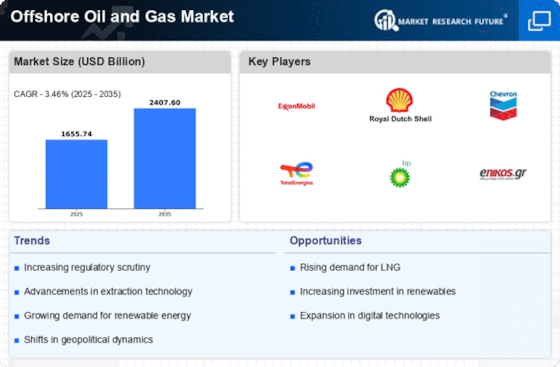

The Offshore Oil and Gas Market Industry is experiencing a surge in energy demand, driven by population growth and industrialization. As economies expand, the need for reliable energy sources becomes paramount. According to recent data, global energy consumption is projected to increase by approximately 30% by 2040. This rising demand is likely to stimulate investments in offshore oil and gas exploration and production, as these resources are essential for meeting energy needs. Furthermore, the Offshore Oil and Gas Market Industry is expected to play a crucial role in bridging the energy gap, particularly in regions where onshore resources are limited. Consequently, companies are focusing on enhancing their offshore capabilities to capitalize on this growing demand.

Environmental Regulations

The Offshore Oil and Gas Market Industry is increasingly subject to stringent environmental regulations aimed at minimizing ecological impact. Governments are implementing policies that require companies to adopt sustainable practices and reduce carbon emissions. For example, regulations mandating the use of cleaner technologies and the implementation of spill prevention measures are becoming more prevalent. These regulations not only aim to protect marine ecosystems but also encourage innovation within the industry. Companies that proactively comply with these environmental standards may gain a competitive advantage, as consumers and investors increasingly favor sustainable practices. Consequently, the Offshore Oil and Gas Market Industry is likely to evolve, focusing on environmentally responsible exploration and production methods.

Technological Advancements

Technological advancements are significantly shaping the Offshore Oil and Gas Market Industry. Innovations in drilling techniques, such as horizontal drilling and hydraulic fracturing, have enhanced the efficiency and safety of offshore operations. Moreover, the integration of digital technologies, including artificial intelligence and data analytics, is optimizing production processes and reducing operational costs. For instance, the implementation of advanced subsea technologies has improved the ability to extract oil and gas from challenging environments. As a result, the Offshore Oil and Gas Market Industry is likely to witness increased productivity and reduced environmental impact, making it more competitive in the energy sector. These advancements not only enhance operational efficiency but also contribute to the sustainability of offshore projects.

Investment in Renewable Energy Integration

The Offshore Oil and Gas Market Industry is witnessing a growing trend towards the integration of renewable energy sources. As the world shifts towards a more sustainable energy landscape, companies are exploring ways to combine offshore oil and gas operations with renewable technologies, such as wind and solar power. This integration could potentially enhance energy security and reduce reliance on fossil fuels. For instance, offshore wind farms are being developed alongside oil and gas platforms, allowing for shared infrastructure and reduced costs. This trend not only aligns with The Offshore Oil and Gas Industry as a key player in the transition to a low-carbon economy. The potential for hybrid energy solutions may redefine operational strategies and investment priorities in the coming years.