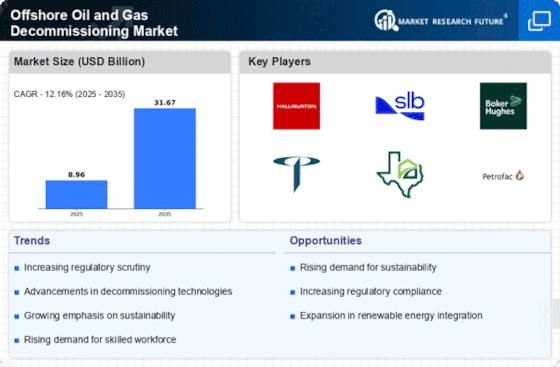

Aging Infrastructure

The Offshore Oil and Gas Decommissioning Market is significantly impacted by the aging infrastructure of offshore oil and gas facilities. Many platforms and rigs are approaching the end of their operational life, necessitating decommissioning to mitigate safety risks and environmental hazards. As of 2025, it is estimated that over 1,000 offshore platforms worldwide will require decommissioning, leading to a substantial increase in market activity. This aging infrastructure creates a pressing need for specialized decommissioning services, which in turn drives market growth. Companies are compelled to invest in advanced technologies and methodologies to efficiently dismantle and dispose of obsolete structures, thereby enhancing the overall safety and sustainability of offshore operations.

Technological Advancements

The Offshore Oil and Gas Decommissioning Market is witnessing a transformative phase driven by technological advancements. Innovations in robotics, automation, and data analytics are revolutionizing decommissioning processes, making them more efficient and cost-effective. For instance, the use of remotely operated vehicles (ROVs) and advanced imaging technologies allows for precise assessments of decommissioning sites, reducing the time and resources required for dismantling operations. As of 2025, the market is expected to see a significant increase in the adoption of these technologies, which could enhance operational efficiency by up to 30%. Consequently, technological advancements are not only streamlining decommissioning activities but also contributing to the overall growth of the Offshore Oil and Gas Decommissioning Market.

Regulatory Compliance Pressure

The Offshore Oil and Gas Decommissioning Market is increasingly influenced by stringent regulatory frameworks aimed at environmental protection and safety. Governments are imposing more rigorous decommissioning standards, necessitating operators to adhere to comprehensive guidelines. This regulatory pressure compels companies to allocate substantial resources towards decommissioning activities, ensuring compliance with local and international laws. As a result, the market is witnessing a surge in demand for decommissioning services, with estimates suggesting that the decommissioning market could reach USD 20 billion by 2025. The need for compliance not only drives operational costs but also encourages innovation in decommissioning technologies, thereby shaping the future landscape of the Offshore Oil and Gas Decommissioning Market.

Investment in Decommissioning Projects

The Offshore Oil and Gas Decommissioning Market is experiencing a surge in investment as companies recognize the financial implications of decommissioning. With the increasing number of aging offshore facilities, operators are allocating substantial budgets to decommissioning projects to avoid potential liabilities associated with abandoned sites. It is estimated that investments in decommissioning could exceed USD 15 billion annually by 2025. This influx of capital is driving the development of new decommissioning technologies and services, fostering competition among service providers. Furthermore, the financial commitment to decommissioning projects reflects a broader industry trend towards responsible asset management, thereby enhancing the overall sustainability of the Offshore Oil and Gas Decommissioning Market.

Environmental Sustainability Initiatives

The Offshore Oil and Gas Decommissioning Market is increasingly shaped by the growing emphasis on environmental sustainability. As stakeholders become more aware of the ecological impacts of offshore operations, there is a heightened demand for environmentally responsible decommissioning practices. Companies are now prioritizing sustainable methods that minimize environmental footprints, such as utilizing biodegradable materials and advanced waste management techniques. This shift towards sustainability is not merely a trend; it is becoming a fundamental requirement for industry players. The market is projected to grow as firms that adopt sustainable practices are likely to gain competitive advantages, potentially leading to a market valuation of USD 25 billion by 2026. Thus, environmental sustainability initiatives are a crucial driver of the Offshore Oil and Gas Decommissioning Market.