Rising Demand for Energy

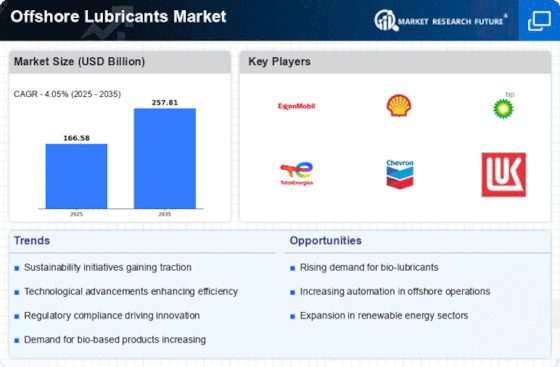

The Offshore Lubricants Market is experiencing a notable increase in demand for energy resources, particularly oil and gas. As countries strive to meet their energy needs, offshore drilling activities are expanding. This surge in exploration and production activities necessitates the use of high-performance lubricants to ensure operational efficiency and equipment longevity. According to recent data, the offshore oil and gas sector is projected to grow at a compound annual growth rate of approximately 5% over the next few years. This growth is likely to drive the demand for specialized lubricants that can withstand harsh marine environments, thereby propelling the Offshore Lubricants Market forward.

Increasing Regulatory Standards

The Offshore Lubricants Market is significantly influenced by the tightening of regulatory standards concerning environmental protection and safety. Governments and international bodies are implementing stringent regulations to minimize the ecological impact of offshore operations. This has led to a growing demand for lubricants that comply with these regulations, particularly those that are biodegradable and non-toxic. Companies are increasingly seeking lubricants that not only meet performance requirements but also adhere to environmental standards. As a result, the Offshore Lubricants Market is expected to see a rise in the development and adoption of eco-friendly lubricant solutions, which could reshape market dynamics.

Expansion of Offshore Wind Energy

The Offshore Lubricants Market is also benefiting from the expansion of offshore wind energy projects. As countries invest in renewable energy sources, the demand for lubricants in wind turbine operations is increasing. Offshore wind farms require specialized lubricants to ensure the smooth functioning of turbines and other equipment exposed to harsh marine conditions. The growth of this sector is projected to contribute significantly to the overall demand for offshore lubricants. With the offshore wind energy market expected to grow at a robust pace, the Offshore Lubricants Market is likely to adapt and innovate to meet the specific needs of this emerging segment.

Global Shipping and Maritime Activities

The Offshore Lubricants Market is closely tied to the growth of global shipping and maritime activities. As international trade continues to expand, the demand for lubricants in shipping operations is on the rise. Vessels operating in offshore environments require high-quality lubricants to ensure optimal performance and reliability. The increasing number of shipping routes and the expansion of maritime infrastructure are likely to drive the demand for offshore lubricants. Furthermore, the need for compliance with international maritime regulations is pushing companies to invest in advanced lubricant solutions. Consequently, the Offshore Lubricants Market is poised for growth as it aligns with the evolving needs of the maritime sector.

Technological Innovations in Lubricants

Technological advancements are playing a pivotal role in shaping the Offshore Lubricants Market. Innovations in lubricant formulations, such as the development of synthetic and bio-based lubricants, are enhancing performance and sustainability. These advanced lubricants are designed to provide superior protection against wear and corrosion, which is crucial in offshore applications. The introduction of smart lubricants, which can monitor equipment conditions and optimize performance, is also gaining traction. As a result, the Offshore Lubricants Market is likely to witness a shift towards more efficient and environmentally friendly products, aligning with the broader trends of technological progress and sustainability.