Top Industry Leaders in the Offshore Lubricants Market

The offshore lubricants market, a critical cog in the machinery of global energy exploration and production, is witnessing a dynamic and complex competitive landscape. Players navigate a sea of opportunities and challenges, with innovation, strategic maneuvering, and regional focus serving as key anchors for staying afloat. Let's dive deep into this dynamic market, exploring its competitive landscape, market share drivers, recent developments, and industry news.

The offshore lubricants market, a critical cog in the machinery of global energy exploration and production, is witnessing a dynamic and complex competitive landscape. Players navigate a sea of opportunities and challenges, with innovation, strategic maneuvering, and regional focus serving as key anchors for staying afloat. Let's dive deep into this dynamic market, exploring its competitive landscape, market share drivers, recent developments, and industry news.

Strategies Adopted by Offshore Lubricant Players:

-

Innovation: Technological advancements are paramount. Companies like Shell invest heavily in bio-based and biodegradable lubricants, catering to environmental concerns and stringent regulations. Total, meanwhile, focuses on developing lubricants for extreme high-pressure and low-temperature conditions, pushing the boundaries of performance. -

Partnerships and Collaborations: Joining forces with equipment manufacturers and service providers is crucial. ExxonMobil, for instance, partnered with Siemens for joint lubricant recommendations, while Chevron collaborates with shipyards for early-stage lubricant integration into vessels. -

Regional Focus: Tailoring offerings to specific regions is key. BP caters to the growing Middle Eastern market with desert-adapted lubricants, while Castrol targets the Asia Pacific region with cost-effective and fuel-efficient lubricants. -

Sustainability Drive: Environmental consciousness is shaping the market. Companies like Lukoil emphasize energy-saving lubricants, while Idemitsu Kosan focuses on lubricants derived from recycled materials. -

M&A Activity: Consolidation through mergers and acquisitions is on the rise. The recent acquisition of JX Nippon Oil & Energy by Idemitsu Kosan aims to create a leading Asian player, while rumors swirl about potential consolidation among European players.

Factors Driving Market Share:

-

End-Use Segments: Offshore rigs, FPSOs (Floating, Production, Storage & Offloading vessels), and OSVs (Offshore Support Vessels) each have specific lubricant needs. Mastering these demands and building strong relationships with operators in each segment fuels market share growth. -

Product Portfolio Breadth: Offering a diverse range of lubricants for various applications, from engine oils to greases, attracts a wider customer base. Companies like Shell and ExxonMobil excel in this aspect. -

Brand Reputation and Trust: Established brands like Total and Chevron benefit from their long history and proven track record in the industry, commanding customer loyalty and premium pricing power. -

Regulatory Compliance: Adapting to evolving environmental and safety regulations is crucial. Companies like BP invest heavily in developing lubricants that meet stringent international standards, gaining access to restricted markets. -

Cost-Effectiveness: Balancing performance with affordability is key, especially in price-sensitive regions. Players like Gulf Oil and Lukoil cater to this segment with competitively priced lubricants.

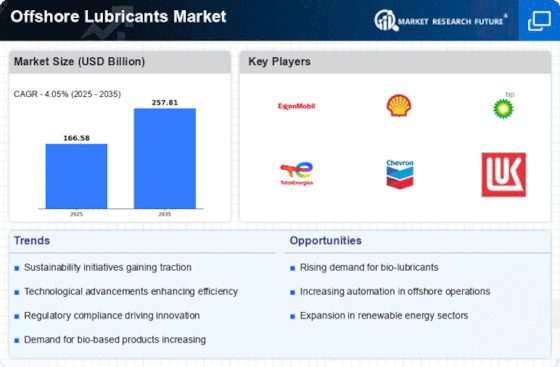

Key Players

- BP plc (U.K.)

- Chevron Corporation (U.S.)

- Exxon Mobil Corporation (U.S.)

- Royal Dutch Shell plc (Netherlands)

- Total S.A. (France)

- Aegean Marine Petroleum (Greece)

- Fuchs Petrolub SE (Germany)

- Gulf Oil Corporation (U.S.)

- Idemitsu Kosan Co., Ltd. (Japan)

- JXTG Nippon Oil & Energy Corporation (Japan).

Recent Developments :

-

August 2023: ExxonMobil launches a new line of high-performance lubricants specifically designed for harsh offshore environments in the North Sea. -

September 2023: Shell partners with a leading wind farm operator to develop lubricants for offshore wind turbines, marking its entry into the renewable energy space. -

October 2023: Total acquires a major lubricant distributor in Southeast Asia, expanding its regional reach and market share. -

November 2023: Chevron announces a research collaboration with a university to develop biodegradable lubricants for offshore applications. -

December 2023: Lukoil unveils a new cost-effective lubricant line targeting budget-conscious offshore operators in emerging markets.