Growth of E-commerce Platforms

The Office Stationery Market is witnessing a significant transformation due to the rise of e-commerce platforms. With the increasing preference for online shopping, businesses and consumers alike are turning to digital channels for their stationery needs. Data suggests that e-commerce sales in the office supplies sector have surged by over 30% in the past year, indicating a shift in purchasing behavior. This trend is particularly pronounced among small and medium-sized enterprises that seek convenience and cost-effectiveness. E-commerce platforms provide a vast array of products, competitive pricing, and the ability to compare options easily, which enhances the overall shopping experience. As a result, traditional brick-and-mortar stores are compelled to adapt their strategies to remain competitive within the Office Stationery Market, often by enhancing their online presence and offering exclusive online deals.

Expansion of Hybrid Work Models

The Office Stationery Market is adapting to the expansion of hybrid work models, which combine remote and in-office work. As organizations embrace flexible work arrangements, the demand for versatile stationery products that cater to both environments is increasing. Data shows that 70% of companies are now implementing hybrid work policies, leading to a surge in the need for portable and multifunctional office supplies. This trend is reshaping product offerings, as manufacturers focus on creating items that are suitable for both home and office use. Additionally, the rise of hybrid work is driving innovation in product design, with an emphasis on ergonomics and functionality. As businesses seek to equip their employees with the necessary tools for productivity, the Office Stationery Market is likely to see sustained growth in this segment.

Rising Importance of Personalization

The Office Stationery Market is increasingly influenced by the rising importance of personalization in consumer products. As individuals and businesses seek to express their unique identities, customized stationery items are becoming more popular. This trend is particularly evident in the demand for personalized notebooks, planners, and writing instruments. Recent surveys indicate that nearly 60% of consumers are willing to pay a premium for customized products, suggesting a lucrative opportunity for manufacturers. Personalization not only enhances user experience but also fosters brand loyalty, as customers are more likely to return to brands that offer tailored solutions. This shift towards personalization is prompting companies within the Office Stationery Market to explore innovative design options and customization technologies, thereby creating a more engaging shopping experience for consumers.

Increased Demand for Eco-Friendly Products

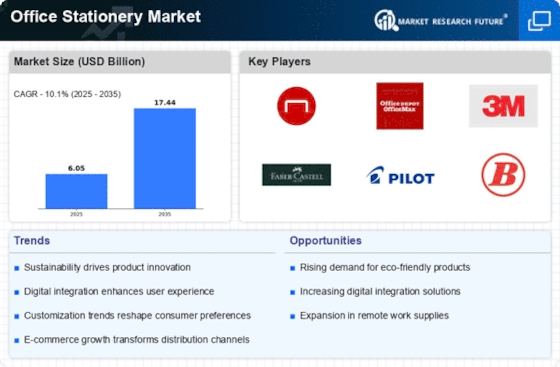

The Office Stationery Market experiences a notable shift towards eco-friendly products, driven by heightened consumer awareness regarding environmental sustainability. As organizations increasingly adopt green policies, the demand for recycled paper, biodegradable pens, and sustainable office supplies rises. Recent data indicates that the market for eco-friendly stationery is projected to grow at a compound annual growth rate of 8.5% over the next five years. This trend not only reflects a commitment to environmental responsibility but also aligns with corporate social responsibility initiatives. Companies are now prioritizing suppliers who offer sustainable options, thereby influencing purchasing decisions across the Office Stationery Market. The integration of eco-friendly materials into product lines is becoming a competitive advantage, as businesses seek to enhance their brand image while meeting consumer expectations.

Technological Advancements in Office Supplies

Technological advancements are reshaping the Office Stationery Market, as innovative products emerge to meet the evolving needs of consumers. The integration of smart technology into stationery items, such as digital notepads and smart pens, is gaining traction. These products not only enhance productivity but also appeal to tech-savvy users who seek multifunctional tools. Market analysis indicates that the segment for technologically integrated stationery is expected to grow by 12% annually, reflecting a strong consumer interest in efficiency and convenience. Furthermore, the rise of remote work has accelerated the demand for such products, as individuals seek to optimize their home office setups. Consequently, manufacturers are investing in research and development to create cutting-edge solutions that cater to the modern workforce, thereby driving growth within the Office Stationery Market.