Expansion of Automotive Sector

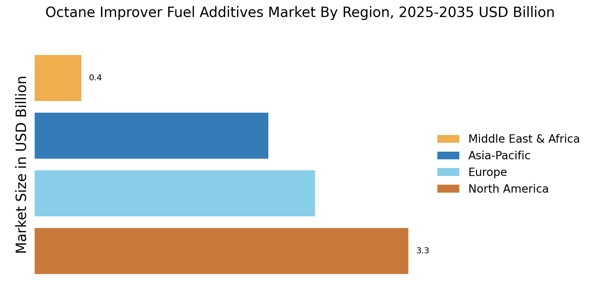

The expansion of the automotive sector is a key driver for the Octane Improver Fuel Additives Market. As vehicle production increases, particularly in emerging markets, the demand for high-quality fuels that enhance performance is also on the rise. This trend is further fueled by the growing popularity of performance vehicles and the increasing number of consumers opting for premium fuel options. Market analysis indicates that the automotive sector is expected to grow at a rate of 5.5% annually, which will likely lead to a corresponding increase in the demand for octane improvers. This growth presents a substantial opportunity for manufacturers within the Octane Improver Fuel Additives Market.

Consumer Awareness and Education

Consumer awareness regarding the benefits of high-octane fuels is gradually increasing, which is positively impacting the Octane Improver Fuel Additives Market. As consumers become more informed about the advantages of using octane improvers, such as improved engine performance and fuel efficiency, the demand for these additives is likely to rise. Educational campaigns by fuel manufacturers and automotive companies are playing a crucial role in this regard. This heightened awareness is expected to translate into a market growth rate of approximately 4% annually, as consumers actively seek products that enhance their driving experience and contribute to vehicle longevity.

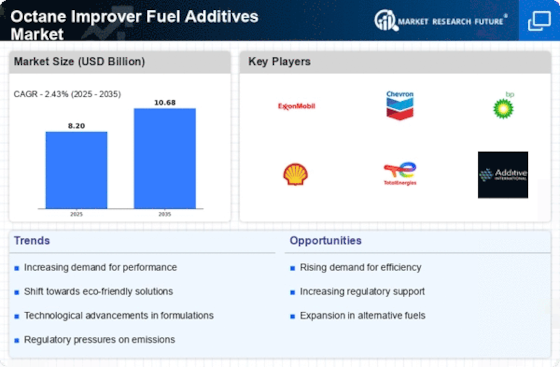

Environmental Regulations and Standards

The Octane Improver Fuel Additives Market is significantly influenced by stringent environmental regulations aimed at reducing emissions from vehicles. Governments across various regions are implementing policies that mandate lower emissions, thereby encouraging the use of fuel additives that enhance octane ratings. These regulations not only promote cleaner combustion but also improve fuel efficiency, aligning with global sustainability goals. As a result, the demand for octane improvers is expected to rise, as manufacturers seek to comply with these standards. The market is projected to witness a growth rate of around 5% annually, driven by these regulatory frameworks that favor the adoption of advanced fuel technologies.

Rising Demand for High-Performance Fuels

The Octane Improver Fuel Additives Market is experiencing a notable increase in demand for high-performance fuels. This trend is largely driven by the automotive sector, where consumers are increasingly seeking vehicles that offer enhanced performance and efficiency. As a result, fuel manufacturers are compelled to incorporate octane improvers to meet these expectations. According to recent data, the market for high-octane fuels is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. This growth is indicative of a broader shift towards performance-oriented fuel solutions, which is likely to bolster the Octane Improver Fuel Additives Market significantly.

Technological Innovations in Fuel Formulation

Technological advancements in fuel formulation are playing a pivotal role in shaping the Octane Improver Fuel Additives Market. Innovations such as the development of new chemical compounds and blending techniques are enhancing the efficacy of octane improvers. These advancements not only improve fuel performance but also contribute to better engine protection and efficiency. The introduction of bio-based additives is also gaining traction, appealing to environmentally conscious consumers. As these technologies evolve, they are expected to drive market growth, with estimates suggesting a potential increase in market size by 6% over the next few years, reflecting the industry's adaptability to changing consumer preferences.