Rising Demand in Textile Industry

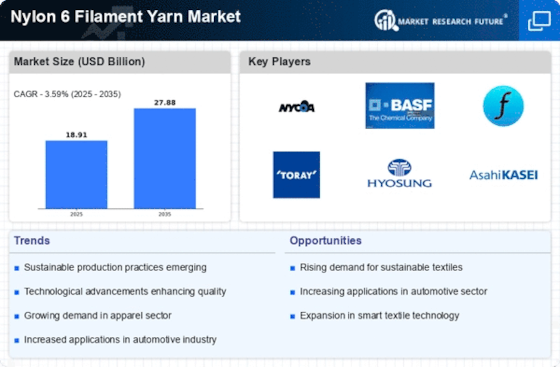

The Nylon 6 Filament Yarn Market is experiencing a surge in demand driven by the textile sector. As fashion trends evolve, manufacturers are increasingly seeking high-performance materials that offer durability and versatility. Nylon 6 filament yarn, known for its strength and elasticity, is becoming a preferred choice for various applications, including apparel, home textiles, and industrial fabrics. According to recent data, the textile industry is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years, which bodes well for the Nylon 6 Filament Yarn Market. This growth is likely to be fueled by the increasing consumer preference for lightweight and comfortable fabrics, further solidifying the position of nylon yarns in the market.

Increasing Focus on Sustainability

The increasing focus on sustainability is reshaping the Nylon 6 Filament Yarn Market. As consumers become more environmentally conscious, there is a growing demand for sustainable materials in textiles. Manufacturers are responding by developing eco-friendly nylon yarns, which are produced using recycled materials or through processes that minimize environmental impact. This shift towards sustainability is not only a response to consumer preferences but also aligns with regulatory pressures aimed at reducing waste and promoting circular economy practices. The Nylon 6 Filament Yarn Market is likely to benefit from this trend, as companies that prioritize sustainability may gain a competitive edge and attract a broader customer base.

Innovations in Manufacturing Processes

Innovations in manufacturing processes are significantly impacting the Nylon 6 Filament Yarn Market. Advances in production technologies, such as the development of more efficient spinning techniques and the integration of automation, are enhancing the quality and consistency of nylon filament yarns. These innovations not only reduce production costs but also improve the environmental footprint of manufacturing operations. For instance, the introduction of closed-loop systems in production can minimize waste and energy consumption. As a result, manufacturers are better positioned to meet the growing demand for sustainable products, which is becoming increasingly important in the Nylon 6 Filament Yarn Market. This trend suggests a potential for increased market share for companies that adopt these advanced manufacturing practices.

Expansion of E-commerce and Online Retail

The expansion of e-commerce and online retail is significantly influencing the Nylon 6 Filament Yarn Market. As more consumers turn to online platforms for their shopping needs, the demand for various textile products, including those made from nylon filament yarn, is expected to rise. E-commerce provides manufacturers with a broader reach and the ability to cater to niche markets that may have been previously underserved. This trend is likely to enhance the visibility of nylon products and facilitate direct-to-consumer sales, which can lead to increased revenue streams for companies in the Nylon 6 Filament Yarn Market. Furthermore, the convenience of online shopping may encourage consumers to explore and purchase innovative textile solutions.

Growth in Automotive and Industrial Applications

The Nylon 6 Filament Yarn Market is witnessing growth due to its expanding applications in the automotive and industrial sectors. Nylon 6 filament yarn is utilized in various automotive components, including seat belts, airbags, and upholstery, owing to its high tensile strength and resistance to abrasion. The automotive industry is projected to grow steadily, with an expected increase in production rates, which will likely drive demand for nylon yarns. Additionally, the industrial sector is adopting nylon filament yarn for applications such as conveyor belts and ropes, further diversifying its market presence. This diversification indicates a robust potential for growth within the Nylon 6 Filament Yarn Market, as manufacturers seek materials that enhance performance and safety.