Emergence of Edge Computing

The emergence of edge computing is reshaping the landscape of the iot sensor market. By processing data closer to the source, edge computing reduces latency and bandwidth usage, which is particularly beneficial for applications requiring real-time data analysis. This technology is gaining traction in sectors such as manufacturing, transportation, and smart homes. The North American edge computing market is projected to grow at a CAGR of 30% from 2025 to 2030, indicating a strong demand for integrated IoT solutions. As organizations increasingly adopt edge computing architectures, the need for efficient IoT sensors that can operate in these environments will likely rise. This trend suggests a transformative impact on the market, as businesses seek to leverage the benefits of edge computing in conjunction with IoT technologies.

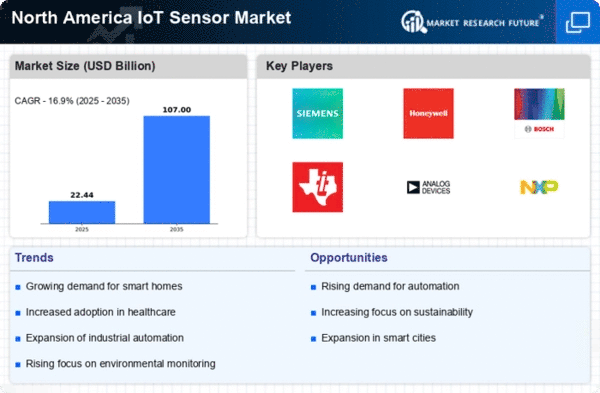

Rising Demand for Automation

The increasing demand for automation across various sectors is a pivotal driver for the iot sensor market. Industries such as manufacturing, agriculture, and healthcare are increasingly integrating automated systems to enhance operational efficiency. For instance, the manufacturing sector is projected to invest approximately $200 billion in automation technologies by 2026, which includes the deployment of IoT sensors. These sensors facilitate real-time monitoring and control, thereby optimizing processes and reducing costs. As organizations seek to streamline operations and improve productivity, the reliance on IoT sensors is expected to grow significantly. This trend indicates a robust market potential for IoT sensor solutions, as businesses aim to leverage data-driven insights to make informed decisions.

Growing Focus on Smart Cities

The growing focus on developing smart cities is a significant driver for the iot sensor market. Urbanization trends indicate that by 2030, nearly 68% of the global population will reside in urban areas, necessitating the implementation of smart solutions to manage resources effectively. In North America, cities are increasingly adopting IoT technologies to improve infrastructure, transportation, and public safety. For example, smart traffic management systems utilize IoT sensors to monitor traffic flow and reduce congestion. The investment in smart city initiatives is projected to exceed $100 billion by 2025, creating substantial demand for IoT sensors. This trend suggests that as cities evolve, the integration of IoT sensors will be critical in enhancing urban living and operational efficiency.

Increased Investment in Healthcare Technologies

The increased investment in healthcare technologies is driving growth in the iot sensor market. The healthcare sector is increasingly adopting IoT solutions to enhance patient care and streamline operations. For instance, remote patient monitoring systems utilize IoT sensors to collect real-time health data, enabling healthcare providers to make timely decisions. The North American healthcare IoT market is projected to reach $100 billion by 2026, reflecting a growing emphasis on digital health solutions. This surge in investment is likely to create a robust demand for IoT sensors, as they play a crucial role in enabling data collection and analysis. As healthcare organizations seek to improve patient outcomes and operational efficiency, the reliance on IoT sensors is expected to intensify.

Advancements in Wireless Communication Technologies

The rapid advancements in wireless communication technologies are significantly influencing the iot sensor market. Technologies such as 5G and LPWAN (Low Power Wide Area Network) are enhancing the connectivity and performance of IoT devices. The deployment of 5G networks is anticipated to provide faster data transmission speeds and lower latency, which are crucial for real-time applications. According to industry estimates, the number of connected IoT devices in North America is expected to reach 30 billion by 2025, driven by these advancements. This proliferation of devices necessitates the use of efficient and reliable sensors, thereby propelling the growth of the IoT sensor market. Enhanced connectivity will likely enable new applications and use cases, further expanding market opportunities.