Focus on Cost Reduction

In the competitive landscape of the industrial boilers market in North America, companies are increasingly focused on cost reduction strategies. Rising energy prices and operational costs compel industries to seek more efficient boiler solutions that minimize fuel consumption and maintenance expenses. By investing in high-efficiency boilers, companies can achieve substantial savings over time. Reports suggest that businesses can reduce their energy costs by up to 20% by upgrading to modern boiler systems. This focus on cost efficiency not only drives sales in the industrial boilers market but also encourages manufacturers to develop products that meet the evolving needs of cost-conscious consumers.

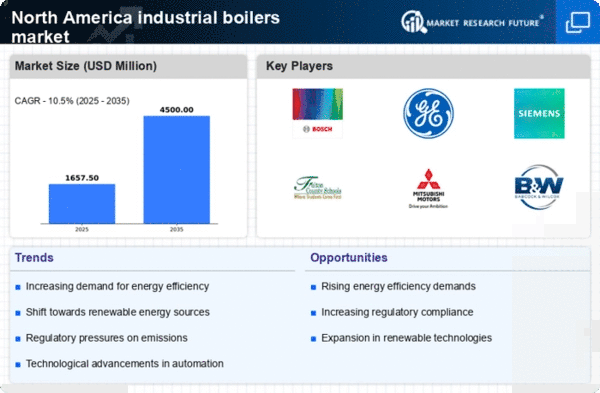

Rising Industrial Demand

The industrial boilers market in North America experiences a notable surge in demand due to the expansion of various sectors such as manufacturing, food processing, and pharmaceuticals. As industries strive to enhance productivity, the need for efficient heating solutions becomes paramount. In 2025, the market is projected to reach approximately $3 billion, reflecting a compound annual growth rate (CAGR) of around 5%. This growth is driven by the increasing need for reliable steam and hot water generation, which is essential for numerous industrial processes. Consequently, manufacturers are compelled to innovate and upgrade their boiler systems to meet the rising demand, thereby propelling the industrial boilers market forward.

Technological Advancements

Technological advancements play a crucial role in shaping the industrial boilers market in North America. Innovations such as modular boiler systems, advanced control technologies, and improved heat recovery systems enhance operational efficiency and reduce fuel consumption. The integration of IoT and automation in boiler systems allows for real-time monitoring and predictive maintenance, which can lead to significant cost savings. As industries increasingly prioritize efficiency, the adoption of these advanced technologies is expected to rise. By 2026, the market for technologically advanced boilers could account for over 40% of total sales, indicating a strong trend towards modernization in the industrial boilers market.

Regulatory Frameworks and Standards

The industrial boilers market in North America is significantly influenced by stringent regulatory frameworks aimed at reducing emissions and enhancing energy efficiency. Government agencies enforce regulations that mandate compliance with environmental standards, compelling industries to adopt advanced boiler technologies. For instance, the Environmental Protection Agency (EPA) has established guidelines that necessitate the use of low-emission boilers. This regulatory landscape not only drives the adoption of cleaner technologies but also fosters innovation within the industrial boilers market. As companies invest in compliant systems, the market is likely to witness a shift towards more sustainable practices, ultimately benefiting both the environment and the industry.

Shift Towards Renewable Energy Sources

The industrial boilers market in North America is witnessing a gradual shift towards renewable energy sources as industries seek to reduce their carbon footprint. The increasing availability of biomass, solar, and geothermal energy options presents new opportunities for boiler manufacturers. This transition is supported by government incentives and subsidies aimed at promoting sustainable energy practices. As industries adopt renewable energy solutions, the demand for boilers that can efficiently utilize these resources is expected to rise. By 2027, it is anticipated that renewable energy boilers could represent a significant portion of the market, reflecting a broader trend towards sustainability in the industrial boilers market.