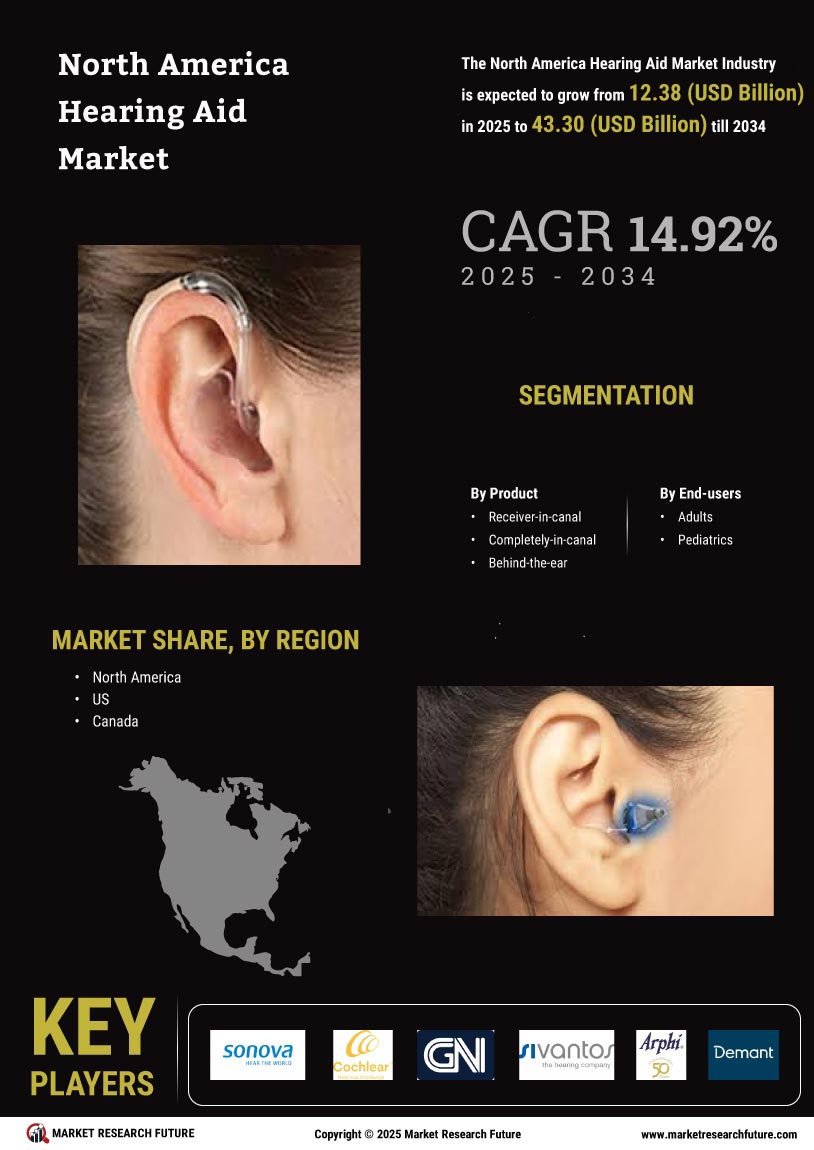

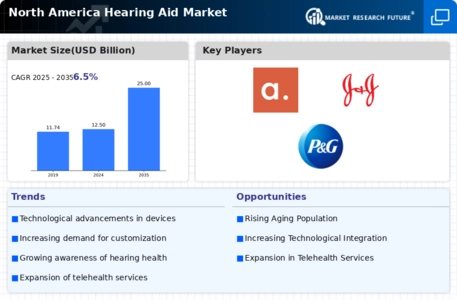

The Hearing Aids Market in North America is characterized by a dynamic competitive landscape, driven by technological advancements, an aging population, and increasing awareness of hearing health. Major players such as Sonova Holding AG (CH), Demant A/S (DK), and GN Store Nord A/S (DK) are at the forefront, each adopting distinct strategies to enhance their market presence. Sonova, for instance, emphasizes innovation through its extensive R&D investments, focusing on developing advanced hearing solutions that integrate seamlessly with digital technologies. Meanwhile, Demant has been expanding its product portfolio through strategic acquisitions, thereby enhancing its competitive edge in the market. GN Store Nord, on the other hand, is leveraging partnerships to enhance its distribution channels, which collectively shapes a competitive environment that is increasingly focused on technological integration and customer-centric solutions.

In terms of business tactics, companies are localizing manufacturing to reduce costs and optimize supply chains, which is particularly relevant in the context of fluctuating global trade dynamics. The market structure appears moderately fragmented, with several key players exerting influence while also allowing for niche companies to thrive. This fragmentation fosters innovation, as companies strive to differentiate themselves through unique offerings and enhanced customer experiences.

In November 2025, Sonova Holding AG (CH) announced the launch of its latest hearing aid model, which incorporates AI-driven features aimed at personalizing user experiences. This strategic move not only reinforces Sonova's commitment to innovation but also positions the company to capture a larger share of the tech-savvy consumer segment, which increasingly seeks smart hearing solutions. The integration of AI is likely to enhance user satisfaction and retention, thereby driving long-term growth.

In December 2025, Demant A/S (DK) completed the acquisition of a regional hearing aid manufacturer, which is expected to bolster its market presence in North America. This acquisition aligns with Demant's strategy to expand its footprint and diversify its product offerings, allowing for greater market penetration. The move is indicative of a broader trend where consolidation is becoming a key strategy for companies aiming to enhance operational efficiencies and broaden their customer base.

In January 2026, GN Store Nord A/S (DK) unveiled a new partnership with a leading telehealth provider to offer remote audiology services. This initiative reflects a growing trend towards digital health solutions, enabling GN Store Nord to tap into the increasing demand for accessible healthcare services. By integrating telehealth into its offerings, the company is likely to enhance customer engagement and streamline service delivery, which could prove advantageous in a competitive market.

As of January 2026, the competitive trends in the Hearing Aids Market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming pivotal, as companies collaborate to enhance their technological capabilities and expand their service offerings. The competitive differentiation is shifting from price-based strategies to a focus on innovation, technology, and supply chain reliability, suggesting that companies that prioritize these areas are likely to thrive in the evolving landscape.