Aging Population

The aging population worldwide presents a unique challenge and opportunity for the Global Bariatric Surgery Market Industry. Older adults are more susceptible to obesity and its associated health complications, necessitating effective weight management solutions. As life expectancy increases, the demand for bariatric surgeries is likely to rise, as older individuals seek to improve their quality of life. This demographic shift is expected to drive market growth, with projections indicating a significant increase in the number of procedures performed. By 2035, the market could expand to 6.11 USD Billion, reflecting the growing need for tailored surgical interventions for the aging population within the Global Bariatric Surgery Market Industry.

Rising Obesity Rates

The increasing prevalence of obesity globally serves as a primary driver for the Global Bariatric Surgery Market Industry. According to data, the World Health Organization indicates that obesity rates have tripled since 1975, with over 650 million adults classified as obese in 2022. This alarming trend is likely to propel the demand for bariatric surgeries, as individuals seek effective solutions for weight management. The market is projected to reach 2.34 USD Billion in 2024, reflecting a growing recognition of surgical interventions as viable options for severe obesity. As awareness of obesity-related health risks increases, the Global Bariatric Surgery Market Industry is expected to expand significantly.

Technological Advancements

Innovations in surgical techniques and technologies are transforming the landscape of the Global Bariatric Surgery Market Industry. Minimally invasive procedures, such as laparoscopic surgeries, have gained traction due to their reduced recovery times and lower complication rates. The introduction of robotic-assisted surgeries further enhances precision and patient outcomes. These advancements not only improve the efficacy of bariatric procedures but also attract a broader patient demographic. As a result, the market is anticipated to grow, with projections indicating a rise to 6.11 USD Billion by 2035. The integration of cutting-edge technology is likely to play a pivotal role in shaping the future of the Global Bariatric Surgery Market Industry.

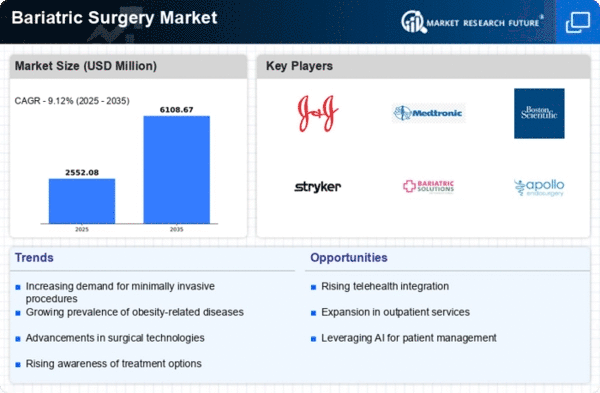

Market Trends and Projections

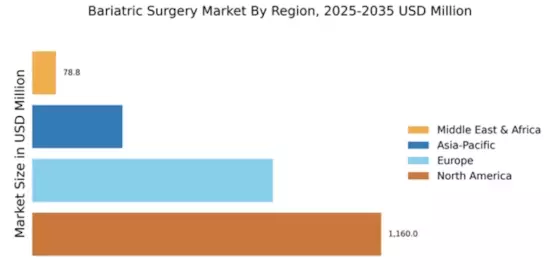

The Global Bariatric Surgery Market Industry is characterized by dynamic trends and projections that indicate substantial growth. The market is expected to reach 2.34 USD Billion in 2024, with a robust compound annual growth rate of 9.12% anticipated from 2025 to 2035. This growth is driven by factors such as rising obesity rates, technological advancements, and increased awareness of surgical options. The market's trajectory suggests a promising future, with potential expansions in both developed and emerging economies. As healthcare systems adapt to the growing demand for bariatric procedures, the Global Bariatric Surgery Market Industry is poised for significant transformation.

Rising Healthcare Expenditure

The escalation of healthcare expenditure globally is another significant driver for the Global Bariatric Surgery Market Industry. As countries invest more in healthcare infrastructure and services, access to surgical interventions improves. This trend is particularly evident in developed nations, where healthcare systems are increasingly prioritizing obesity treatment. For instance, the United States has seen a surge in insurance coverage for bariatric procedures, making them more accessible to patients. This increase in healthcare spending is likely to facilitate the growth of the market, with projections suggesting it will reach 2.34 USD Billion in 2024. Enhanced access to bariatric surgery is expected to contribute positively to the Global Bariatric Surgery Market Industry.

Increased Awareness and Acceptance

There is a growing awareness and acceptance of bariatric surgery as a legitimate treatment for obesity and related comorbidities. Public health campaigns and educational initiatives have contributed to changing perceptions, highlighting the benefits of surgical interventions. This shift in mindset is crucial for the Global Bariatric Surgery Market Industry, as it encourages individuals to consider surgery as a viable option. Moreover, healthcare providers are increasingly recommending bariatric procedures as part of comprehensive weight management strategies. As awareness continues to rise, the market is expected to experience a compound annual growth rate of 9.12% from 2025 to 2035, indicating a robust future for the Global Bariatric Surgery Market Industry.