Expansion of Distribution Channels

The flavored water market is witnessing an expansion of distribution channels, which plays a crucial role in increasing product accessibility. Retailers are diversifying their offerings by including flavored water in various formats, such as single-serve bottles and multi-packs. E-commerce platforms are also becoming significant players, with online sales of flavored water projected to grow by 15% annually. This trend is particularly relevant in North America, where convenience and accessibility are paramount for consumers. As brands leverage both traditional and digital channels, they enhance their reach and cater to a broader audience. This strategic expansion not only boosts sales but also fosters brand recognition in a competitive marketplace.

Rising Demand for Functional Beverages

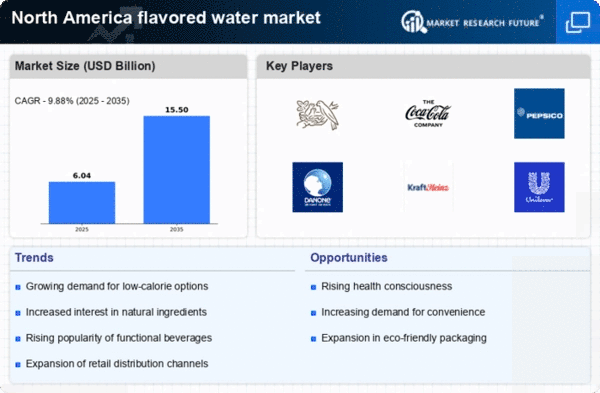

The flavored water market in North America experiences a notable surge in demand for functional beverages. Consumers increasingly seek products that offer health benefits beyond basic hydration. This trend is reflected in the flavored water market, where beverages infused with vitamins, minerals, and antioxidants are gaining traction. According to recent data, the functional beverage segment is projected to grow at a CAGR of approximately 8% over the next five years. This growth is driven by a shift in consumer preferences towards healthier options, as individuals become more aware of the importance of hydration in maintaining overall wellness. As a result, brands are innovating to create flavored waters that not only taste good but also provide added health benefits, thereby expanding their market share in the competitive landscape.

Growing Interest in Hydration Solutions

The flavored water market is benefiting from a growing interest in hydration solutions among consumers. As awareness of the importance of hydration for overall health increases, flavored water is positioned as an appealing alternative to sugary beverages. Recent surveys indicate that nearly 70% of consumers are actively seeking healthier hydration options. This trend is particularly pronounced among younger demographics, who are more inclined to choose flavored water over traditional soft drinks. Brands are capitalizing on this shift by introducing innovative flavors and packaging that resonate with health-conscious consumers. Consequently, the flavored water market is likely to see sustained growth as it aligns with the evolving preferences of the North American consumer base.

Increased Focus on Clean Label Products

In the flavored water market, there is a growing emphasis on clean label products, which are perceived as healthier and more transparent. Consumers are increasingly scrutinizing ingredient lists, favoring beverages that contain natural flavors and minimal additives. This trend aligns with the broader movement towards transparency in food and beverage labeling. Data indicates that approximately 60% of consumers in North America prefer products with simple, recognizable ingredients. As a response, manufacturers are reformulating their flavored water offerings to eliminate artificial sweeteners and preservatives, thereby appealing to health-conscious consumers. This shift not only enhances brand loyalty but also positions companies favorably in a market that values authenticity and quality.

Influence of Social Media and Marketing Strategies

The flavored water market is significantly influenced by social media and innovative marketing strategies. Brands are increasingly utilizing platforms like Instagram and TikTok to engage with consumers, showcasing their products in visually appealing ways. This digital engagement is crucial, as studies suggest that over 50% of consumers are influenced by social media when making beverage choices. Additionally, influencer partnerships and targeted advertising campaigns are becoming common strategies to reach younger audiences. As brands effectively leverage these platforms, they enhance brand visibility and foster a community around their products. This dynamic marketing approach not only drives sales but also cultivates a loyal customer base in the competitive flavored water market.