Innovative Marketing Strategies

The energy drinks market in North America is witnessing a transformation driven by innovative marketing strategies. Brands are leveraging social media platforms, influencer partnerships, and experiential marketing to engage with younger demographics. This approach appears to resonate well, as data suggests that nearly 70% of energy drink consumers are aged between 18 and 34. By creating immersive brand experiences and interactive campaigns, companies are effectively capturing the attention of their target audience. Additionally, the rise of e-commerce has enabled brands to reach consumers directly, further enhancing their market presence. This shift in marketing dynamics is likely to play a crucial role in shaping the future trajectory of the energy drinks market.

Growing Awareness of Mental Health

The energy drinks market in North America is increasingly influenced by the growing awareness of mental health and cognitive well-being. Consumers are becoming more conscious of the impact of stress and fatigue on their mental performance, leading to a heightened interest in products that support mental clarity and focus. Market data indicates that energy drinks formulated with nootropics and adaptogens are gaining traction, as they are perceived to offer cognitive benefits alongside energy boosts. This trend aligns with the broader movement towards holistic health, where consumers seek products that contribute to both physical and mental wellness. As a result, energy drink manufacturers are likely to explore new formulations that cater to this emerging consumer demand.

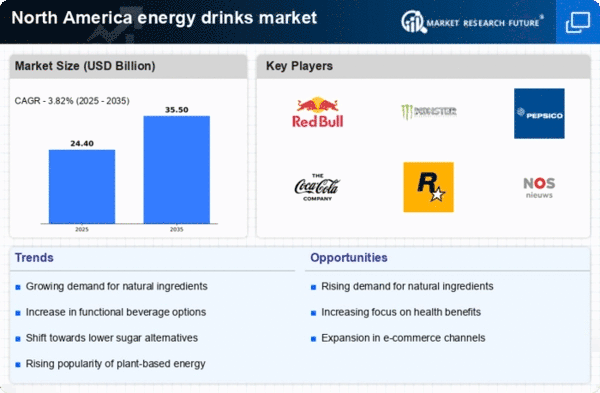

Rising Demand for Functional Beverages

The energy drinks market in North America experiences a notable surge in demand for functional beverages. Consumers increasingly seek products that offer more than just energy; they desire functional benefits such as enhanced cognitive performance, improved physical endurance, and overall wellness. This trend is reflected in the market data, which indicates that the functional energy drinks segment is projected to grow at a CAGR of approximately 8% from 2025 to 2030. As a result, manufacturers are innovating formulations that incorporate vitamins, minerals, and herbal extracts, aligning with consumer preferences for health-oriented products. This shift towards functional beverages is likely to reshape the competitive landscape of the energy drinks market, compelling brands to adapt and diversify their offerings to meet evolving consumer expectations.

Sustainability and Eco-Friendly Packaging

The energy drinks market in North America is increasingly shaped by the emphasis on sustainability and eco-friendly packaging. As environmental concerns gain prominence, consumers are gravitating towards brands that demonstrate a commitment to sustainable practices. Research indicates that approximately 55% of consumers are willing to pay a premium for products packaged in environmentally friendly materials. This trend is prompting energy drink manufacturers to explore innovative packaging solutions, such as biodegradable containers and recyclable materials. By aligning their products with sustainability initiatives, brands not only enhance their market appeal but also contribute to a positive brand image. This focus on sustainability is likely to become a defining characteristic of the energy drinks market in the coming years.

Increased Participation in Sports and Fitness Activities

The energy drinks market in North America is significantly influenced by the growing participation in sports and fitness activities. As more individuals engage in regular exercise and athletic pursuits, the demand for energy-boosting beverages rises correspondingly. Market Research Future indicates that approximately 60% of energy drink consumers are athletes or fitness enthusiasts, seeking products that enhance performance and recovery. This trend is further supported by the proliferation of fitness events, marathons, and sports competitions, which create opportunities for brands to target health-conscious consumers. Consequently, energy drink manufacturers are increasingly marketing their products as essential companions for active lifestyles, thereby driving growth in the energy drinks market.