Innovative Product Offerings

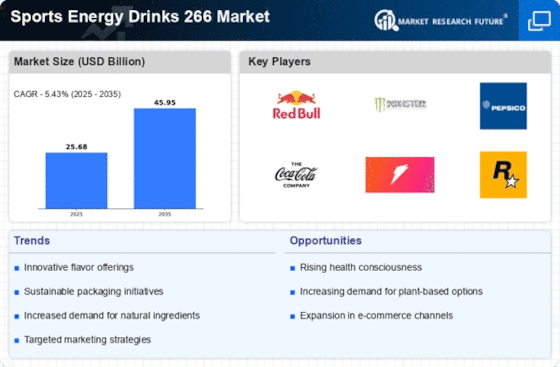

Innovation in product formulations and flavors is a key driver for the Sports Energy Drinks 266 Market. Companies are increasingly introducing unique flavors and functional ingredients, such as adaptogens and electrolytes, to differentiate their products. This trend is supported by market data showing that consumers are willing to pay a premium for innovative and functional beverages. In 2025, the introduction of new products is likely to stimulate growth in the Sports Energy Drinks 266 Market, as brands strive to meet the evolving preferences of health-conscious consumers.

Increased Health Consciousness

The growing awareness of health and wellness among consumers appears to be a pivotal driver for the Sports Energy Drinks 266 Market. As individuals increasingly prioritize fitness and nutrition, they seek beverages that not only provide energy but also contribute to overall health. This trend is reflected in market data, indicating that the demand for low-calorie and natural ingredient energy drinks has surged. In 2025, the market for health-oriented energy drinks is projected to account for a substantial portion of total sales, suggesting that brands focusing on health benefits may capture a larger share of the Sports Energy Drinks 266 Market.

Rising Popularity of Fitness Activities

The increasing participation in fitness activities, such as running, cycling, and gym workouts, is driving demand for energy drinks in the Sports Energy Drinks 266 Market. As more individuals engage in regular exercise, they seek beverages that can enhance performance and recovery. Market data suggests that the fitness sector is expanding, with more consumers incorporating energy drinks into their pre- and post-workout routines. This trend indicates a potential for sustained growth in the Sports Energy Drinks 266 Market, as brands align their marketing strategies with the fitness lifestyle.

Sustainability and Eco-Friendly Packaging

Sustainability has emerged as a significant concern for consumers, influencing their purchasing decisions in the Sports Energy Drinks 266 Market. Brands that adopt eco-friendly practices, such as using recyclable packaging and sourcing sustainable ingredients, may appeal to environmentally conscious consumers. Market Research Future indicates that a growing segment of the population is willing to pay more for products that align with their values regarding sustainability. This shift could lead to increased market share for companies that prioritize environmental responsibility within the Sports Energy Drinks 266 Market.

Expansion of E-Sports and Competitive Gaming

The rise of e-sports and competitive gaming has created a new demographic of consumers for the Sports Energy Drinks 266 Market. Gamers often seek products that enhance focus and endurance during long gaming sessions. This trend has led to an increase in marketing efforts targeting this audience, with brands sponsoring gaming events and influencers. Market analysis indicates that the e-sports sector is expected to grow significantly, potentially driving sales of energy drinks tailored for gamers. This niche market could represent a lucrative opportunity for companies within the Sports Energy Drinks 266 Market.

Leave a Comment