Influence of Aging Population

The aging population in North America serves as a pivotal driver for the cosmetic surgery market. As the demographic landscape shifts, a larger segment of the population is seeking cosmetic procedures to address age-related concerns. Reports indicate that individuals aged 50 and above account for nearly 40% of all cosmetic surgeries performed, highlighting the demand for anti-aging treatments. This trend is likely to persist as the baby boomer generation continues to age, with many individuals desiring to maintain a youthful appearance. The increasing focus on health and wellness among older adults further amplifies this demand, as they seek procedures that enhance their quality of life. Consequently, the cosmetic surgery market is expected to adapt and expand its offerings to cater to this growing demographic, ensuring that it meets the evolving needs of an aging clientele.

Expansion of Non-Surgical Options

The expansion of non-surgical options within the cosmetic surgery market is a notable trend that is reshaping consumer preferences. Treatments such as injectables, fillers, and skin rejuvenation procedures have gained immense popularity due to their minimal downtime and lower costs compared to traditional surgical options. Recent statistics reveal that non-surgical procedures now account for over 60% of the total cosmetic procedures performed, indicating a significant shift in consumer choice. This trend is particularly appealing to younger demographics who may be hesitant to undergo invasive surgeries. As practitioners continue to innovate and improve non-surgical offerings, the market is likely to see sustained growth. The increasing availability and acceptance of these alternatives suggest that the cosmetic surgery market will continue to evolve, catering to a broader audience seeking effective yet less invasive solutions.

Increasing Acceptance of Cosmetic Procedures

The growing acceptance of cosmetic procedures among various demographics is a notable driver in the cosmetic surgery market. As societal norms evolve, more individuals view cosmetic enhancements as a means of self-improvement rather than vanity. This shift is particularly evident among younger generations, with a reported increase of 30% in procedures among individuals aged 18-34 in recent years. The normalization of cosmetic surgery through media representation and celebrity endorsements further contributes to this trend. As acceptance rises, the market is likely to expand, with more individuals seeking surgical and non-surgical options to enhance their appearance. This cultural shift not only influences consumer behavior but also encourages practitioners to innovate and diversify their offerings, thereby stimulating growth in the cosmetic surgery market.

Rising Disposable Income and Consumer Spending

The increase in disposable income among consumers in North America is a significant driver of the cosmetic surgery market. As individuals experience higher earnings, they are more inclined to invest in personal aesthetics. Recent data indicates that consumer spending on cosmetic procedures has risen by approximately 15% over the past few years, reflecting a growing willingness to allocate funds towards enhancing one's appearance. This trend is particularly pronounced among middle to upper-income brackets, where individuals prioritize self-care and personal image. The correlation between economic prosperity and spending on cosmetic enhancements suggests that as the economy continues to improve, the cosmetic surgery market may experience sustained growth. This financial empowerment allows consumers to explore a wider range of options, further fueling demand for various cosmetic procedures.

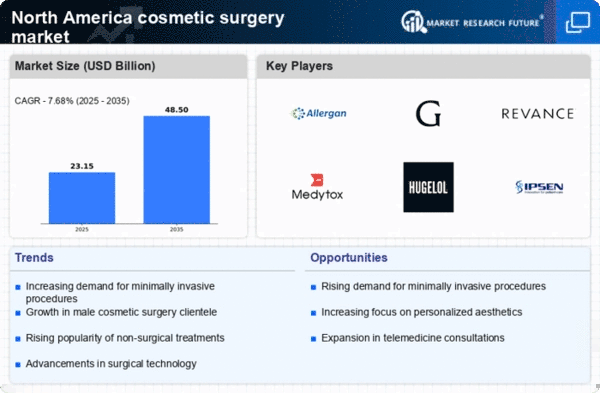

Technological Advancements in Surgical Techniques

Technological advancements play a crucial role in shaping the cosmetic surgery market. Innovations such as 3D imaging, robotic-assisted surgery, and minimally invasive techniques have transformed the landscape of cosmetic procedures. These advancements not only enhance the precision and safety of surgeries but also reduce recovery times, making procedures more appealing to potential clients. For instance, the introduction of laser technology has led to a 25% increase in the popularity of skin resurfacing treatments. As technology continues to evolve, it is expected that the market will witness further growth, with new techniques emerging that cater to the demands of a more informed and discerning clientele. This ongoing evolution in surgical technology is likely to drive competition among practitioners, ultimately benefiting consumers in the cosmetic surgery market.